Welcome to Greenify! Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

Droughts in China’s province Sichuan have caused a 51% fall in daily hydropower generation. Sichuan relies on hydropower for 82% of its power generation…

Hottest news of the week…

Regulation 🗃 - Green Cali!

What happened: California lawmakers passed a climate legislation package this week: this includes $54 billion in new investments on several green initiatives. Out of the whole sum, which will be spent over the next five years, $8 billion will be directed towards the decarbonization of the state’s electrical grid, currently relying on natural gas for the most part🔝. The legislation also contains a bill providing a lifeline to the state’s last nuclear plant, “Diablo Canyon”. Initially planned to shut down in 2024, the plant will be kept open until 2030.

Zoom out: California has historically been a strong “dem” state. No surprises, they take climate policy seriously, in line with President Biden’s view on the matter. This large legislation package comes just days after the huge “IRA” passed by the White House; from the outside, it finally seems politicians have put money where their mouth is 👍. Interestingly, we note the bill includes the postponed closing of the state’s last nuclear plant; a similar story we have recently seen in Germany 🤔.

Business 💰 - U.S. solar PV manufacturers trying to catch up!

What happened: The climate bill included in the Inflation Reduction Act (IRA) is already paying off. First Solar, the largest U.S. solar panel manufacturer announced a $1B investment in a new factory in the country and a $185M upgrade to their Ohio facility. The new factory will produce, every year, 3.5 GW worth of solar panels. Currently, order backlog for First Solar is pretty busy, with 44 GW worth of orders outstanding through 2025! 💪

Zoom out: The CEO of First Solar said the IRA has been the key catalyst pushing the company to build its 4th factory in the U.S. rather than elsewhere, as the stimulus package gives tax incentives to renewables manufacturers! The objective of U.S. leaders is to close the gap with China in solar panels production… An ambitious plan, given the U.S. share in the domestic solar market is only 20%, currently. The remaining 80% is mainly owned by China and its neighbours. The figure seems quite bad right? And remember we are talking about the U.S. market only… other countries are even more Chinese reliant! 😬

Innovation 💡 - Green ammonia delivery from UAE!

What happened: There has been a first shipment of green ammonia from Abu Dhabi toward Germany, an economy heavily based on hard to abate sectors! The cargo came from the Abu Dhabi National Oil Company (ADNOC) and arrived in Hamburg, where it will be utilized by Aurubis, a producer of non-ferrous metals and large copper recycler! According to ADNOC, this shipment is a test, and many more cargos will follow in an effort for the company to expand its clean hydrogen business.👍

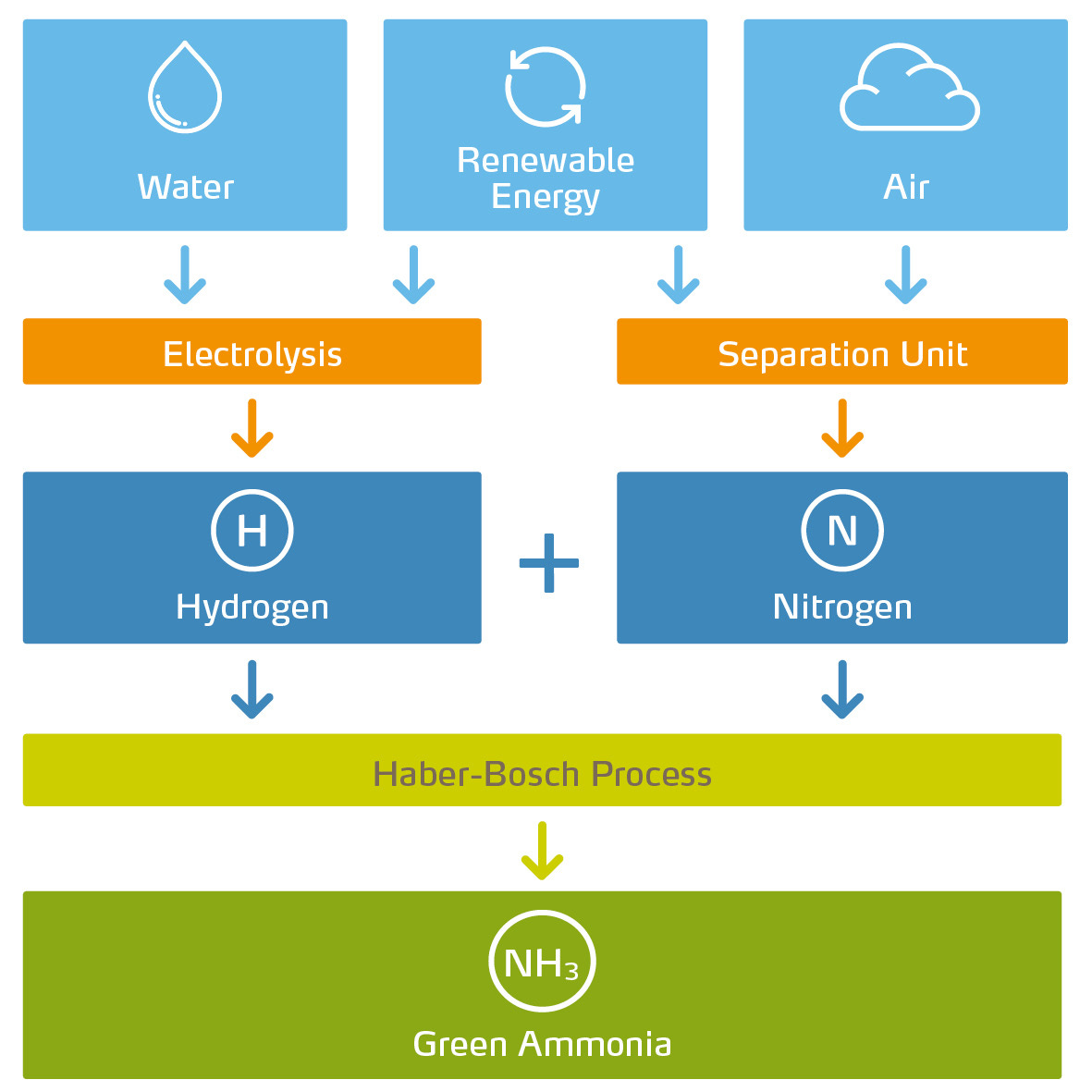

Zoom out: Ammonia is a product composed by hydrogen and nitrogen that is used in uncountable processes. When hydrogen is derived using renewables-powered electrolysis (green hydrogen), the resulting ammonia is defined as green ammonia and has no CO2 emissions! (Check out the picture below😉). Ammonia is mainly used to make fertilizers (80%), but it is increasingly used as as vector to transport green hydrogen more easily or directly as a fuel! Given its many applications, creating an international green ammonia market is crucial to decarbonize certain sectors! 💪

Source: Yara

Deep dives of the week…

Graph of the week - Renewables… we need land ‼️

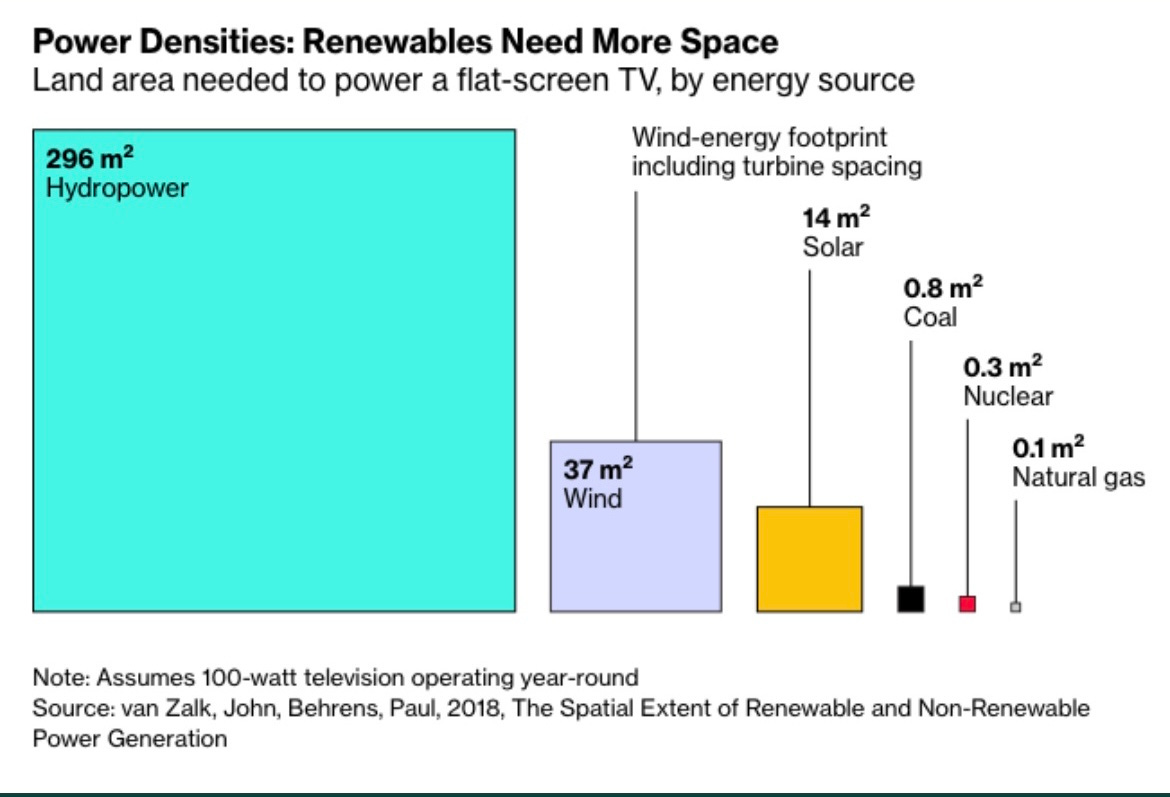

This chart, provided by Bloomberg, shows us a negative aspect of renewables… The energy trilemma consists of three magic words: cheap, clean and reliable: looking at the below diagram, we would suggest the addition of a fourth word… space! At the moment, renewables such as solar and wind tick the first two words, although further work on reliability and space needs to be done! Progress on the first can be done through investment in batteries, while progress on the second might be more challenging! 😬

Source: Bloomberg

Fund of the week - Largest clean hydrogen dedicated fund! 💰

Our fund of the week is the CI Energy Transition Fund I (CI ETF I), the most recent fund created by Copenhagen Infrastructure Partners and focused on greenfield clean hydrogen projects to decarbonize hard to abate sectors💪! The Denmark based fund collected €3 billion, making the CI ETF I the largest clean hydrogen dedicated fund worldwide! The fund started off quickly, already acquiring stakes in several development-stage projects that once fully operational are estimated to reduce 7.5m + tonnes of CO2 per year, equivalent to removing 1.6m cars off the road! That seems like a solid number considering many more investments are on the way!🚀

Tweet of the week - China’s giant leap in EVs 🔋!

This week we came across an interesting Twitter thread which explains how China became the world leader in EVs. It briefly looks into data around the EV penetration, who are the main players, and what are the forecasts for the future. Check it out here for the full version!😎

Source: Twitter

👋See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post and share it with your network