Greenify #5

1st April 2022

Welcome to Greenify, a weekly newsletter aimed at simplifying your digestion of current and crucial matters such as #energytransition #decarbonisation #climatetech. We believe that a clear understanding of these topics is essential to thrive in the world of… TODAY! Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

The world has now enough solar panels installed to generate 1TW of electricity ⚡️ On paper, the current quantity would be enough to meet Europe’s combined electricity demands…

Hottest news of the week…

Regulation 🗃 – U.S. vs. China, Again and Again

What Happened: On Monday, U.S. trade officials said they will start investigating U.S. imports of solar panels from four south-east Asian countries: Vietnam, Malaysia, Thailand and Cambodia. Currently, 80% of installed solar panels in the U.S. come from these countries, and this investigation could potentially lead to tariffs being put in place 😬. The investigation is a result of U.S. solar panel producers’ claims that Chinese producers have moved production to these four countries in order to avoid existing tariffs in place on Chinese solar goods.

Zoom Out: Solar’s technological and economical progress over the last 15 years was phenomenal, as it became an extremely competitive source of energy. Born in the 50s, solar’s development is attributable to four countries mainly: U.S., Australia, Germany and China. China particularly played a key role in scaling the technology and making it affordable, becoming its main reference market. With potential tariffs being applied, overall costs would rise, aka bad news for solar installations… some climate enthusiasts are not that happy about this situation…🤬

Business 💰 – Let’s build LNG Infrastructure!

What happened: European countries are fighting to acquire as much Liquid Natural Gas (LNG) as possible by betting on Floating Storage and Regasification Units (FSRU) i.e. off-shore platforms that regasify LNG arriving by sea and pump it in the on-shore pipelines (You may want to watch this for a better explanation!). In fact, Germany, France and Italy are all planning to construct FSRUs in the next couple of years as well as trying to rent these platforms in the short term, with the aim of mitigating the damages caused by the missing Russian imports 🤧.

Zoom Out: The EU aims to cut 2/3 of Russian gas imports by the end of 2022, and end all imports by 2027, but the feasibility of this plan depends on its ability to find substitutes, and LNG seems like a great one! The problem with LNG lies in the regasification infrastructures, which are scarce and complex to build. Here come FSRUs, as they are way cheaper and faster to build than the on-shore competitors and therefore seem the elected quick-fix to increase LNG imports! Big construction projects will start soon 🚀!

Innovation 💡 - Germany going greener? Gas Out - Hydrogen In

What Happened: German utility company E.ON and Australia’s Fortescue have signed a memorandum of understanding (MoU) to develop a hydrogen supply chain between Australia and Germany, as the latter is desperately trying to reduce dependency on Russia’s gas. However, this is only a MoU, implying the project will only come to life in some years’ time. We think two main questions need to be addressed here: 1) cost 2) the ability of hydrogen to be easily pumped into existing gas infrastructure. On the first, estimates talk about a broad $50bn expenditure💸. On the second, no detail was provided yet 🤔.

Zoom Out: Australia’s Fortescue, an iron ore company, is betting big on renewables through its “green” branch: Fortescue Future Industries (FFI). Fortescue’s CEO Andrew Forrest said he plans to invest 10% of the group’s after-tax profits into FFI in order to speed up the transition. However, we remain with one philosophical question… is Germany really looking into clean energy independency? Removing Russia from its energy supply chain is obviously a positive, but it looks like minor efforts are being undertaken to try and become self-sufficient on clean energy… especially after they recently announced the closure of all remaining nuclear power plants😳.

Deep dives of the week...

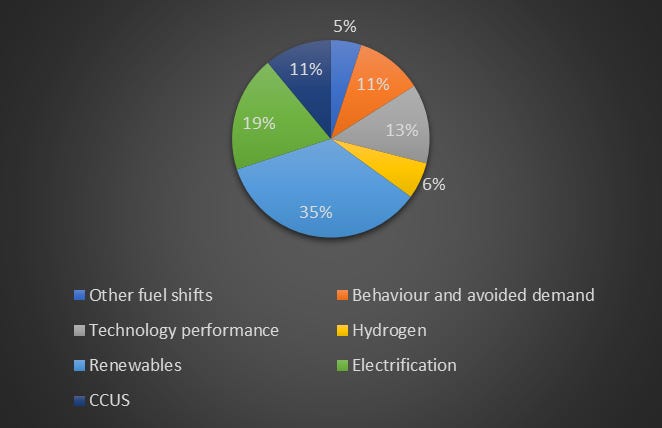

Graph of the Week – How to get to net 0❗

This week we look at cumulative emissions reduction by mitigation measure necessary to achieve the Net Zero Scenario (2021-2050)…. Guess who must play the biggest role? Renewables!

Source: IEA

Company of the Week: Quaise Energy – Unlimited geothermal power?

Our company of the week is Quaise Energy, a spinoff from the MIT that has captured a lot of popularity for its aim to dig as deep as -20km to find the rocks that generate geothermal power almost everywhere on earth. Geothermal power is an extremely efficient source of energy, but currently only available in areas where these rocks are closer to the earth’s surface. Qauise’s solution to drill past the -20km extremely hard rocks would be to send high-frequency waves through the rock to heat it up so that it basically vaporises. Quaise plans to build a functional machine by 2024, and to do so it has raised $63m since 2020…💰 let’s see if they will meet the expectations and make geothermal power unlimited 🚀

Analysis of the Week: The essentials of emissions reporting❗

1. How do companies report emissions 🗃?

Although there is no formal obligation, yet, for companies to report their environmental performance, regulatory bodies are working towards implementing an harmonized system by which corporates will be obliged to do so in the future. Some of them do it already, either in their annual report or their sustainability report, helping out investors who want to allocate capital to the “green winners”.

2. How are emissions split 🔍?

Essentially, you have three categories of emissions: Scope 1,2 and 3.

Scope 1: Emissions arising directly from a company’s activities. For instance, if your final product requires burning fossil fuels such as coal throughout your production process, releasing CO2, this would be Scope 1.

Scope 2: Indirect emissions from purchased energy. For instance, in an office, the electricity used to power your computers.

Scope 3: Other indirect emissions, out of your control. For instance, if you are a manufacturer of plastic products, scope 3 are all of the emissions coming from plastic production itself, coming from the oil & gas industry. Hint, which you probably already figured out yourself: Scope 3 are hardest to measure!

3. What’s the challenge in emissions counting😅?

While Scope 1 and 2 are relatively easy to measure, Scope 3 remain a challenge, as there is no harmonised way in which companies measure them at the moment. Some companies go deeper along their value chain than others. Going forward, we would expect regulators to provide more clarity around this topic.