Welcome to Greenify! Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

Methane emissions, which contributed to roughly 30% of the rise in temperature since the industrial revolution, kept increasing in 2022, despite high energy prices made it economically advantageous to capture it and resell it 🙃

Hottest news of the week…

Regulation 🗃 – NGOs suing banks

What happened: In France, three climate-minded organizations are set to sue BNP Paribas, the eurozone’s largest bank, over fossil fuel lending. Specifically, the three NGOs argue BNP’s lending to oil & gas giants breaches the “duty of vigilance” law adopted by France in 2017, which requires large companies to have a vigilance plan to assess and prevent impact on the environment from their operations. 👮

Zoom out: BNP Paribas, according by the three NGOs, provided the $55 billion of financing between 2016 and 2022 towards the development of fossil fuels. This makes BNP Europe’s largest fossil fuel lender the world's fifth. Having committed to net-zero, some banks have led by example pledging to end financing towards new oil and gas fields by this year; these include HSBC and BBVA among others. 🤔

Business 💰 – Eni pushing hard on biodiesel!

What happened: Just a few days after the EU signed-off the deal to ban ICE vehicles’ sales, Eni announced some big developments on biodiesel! It made available the first 100% biodiesel fuel for vehicles in Italy, distributing it across 50 stations around the country, with a plan to add another 100 in the next months! At the same time, it also announced a joint venture with PBF energy to build a biorefinery in Lousiana (US), committing c.$850 million to set it up! 💣

Zoom out: Despite our provoking first line, EVs and biodiesel (or renewable diesel as it is known in the US) should never be compared. Although biodiesel is a more sustainable version of the standard fuel, as it is derived from vegetal and animal wastes, it still emits GHGs when consumed. However, these fuels can be a transition strategy until we switch to a fully electrified mobility ecosystem, particularly in hard to electrify mobility such as heavy transport. 👍

Innovation 💡 - Tata and Uber, a winning partnership!

What happened: Tata motor and Uber have signed a memorandum of understanding to supply the ride-hailing company with 25,000 EVs! Rumours suggest that Uber drivers should receive an incentive to buy and operate the Tata’s EVs. This move is part of Uber’s commitment to get to a 100% zero-emissions fleet by 2040! 😎

Zoom out: This deal is of massive importance given the size of Uber, which just surpassed 2 billion rides per quarter, equalling to almost 1 million rides each hour, and the sector in which it operates. In fact, ride-hailing is often a substitute of public transports, which have 60% lower emissions per trip on average, hence electrifying the fleet of “taxis” is of crucial importance. Moreover, it is good to know that this deal happened in India, one of the largest emitting country, and where sustainable initiatives are often benched for more economical ones. 💪

Deep dives of the week…

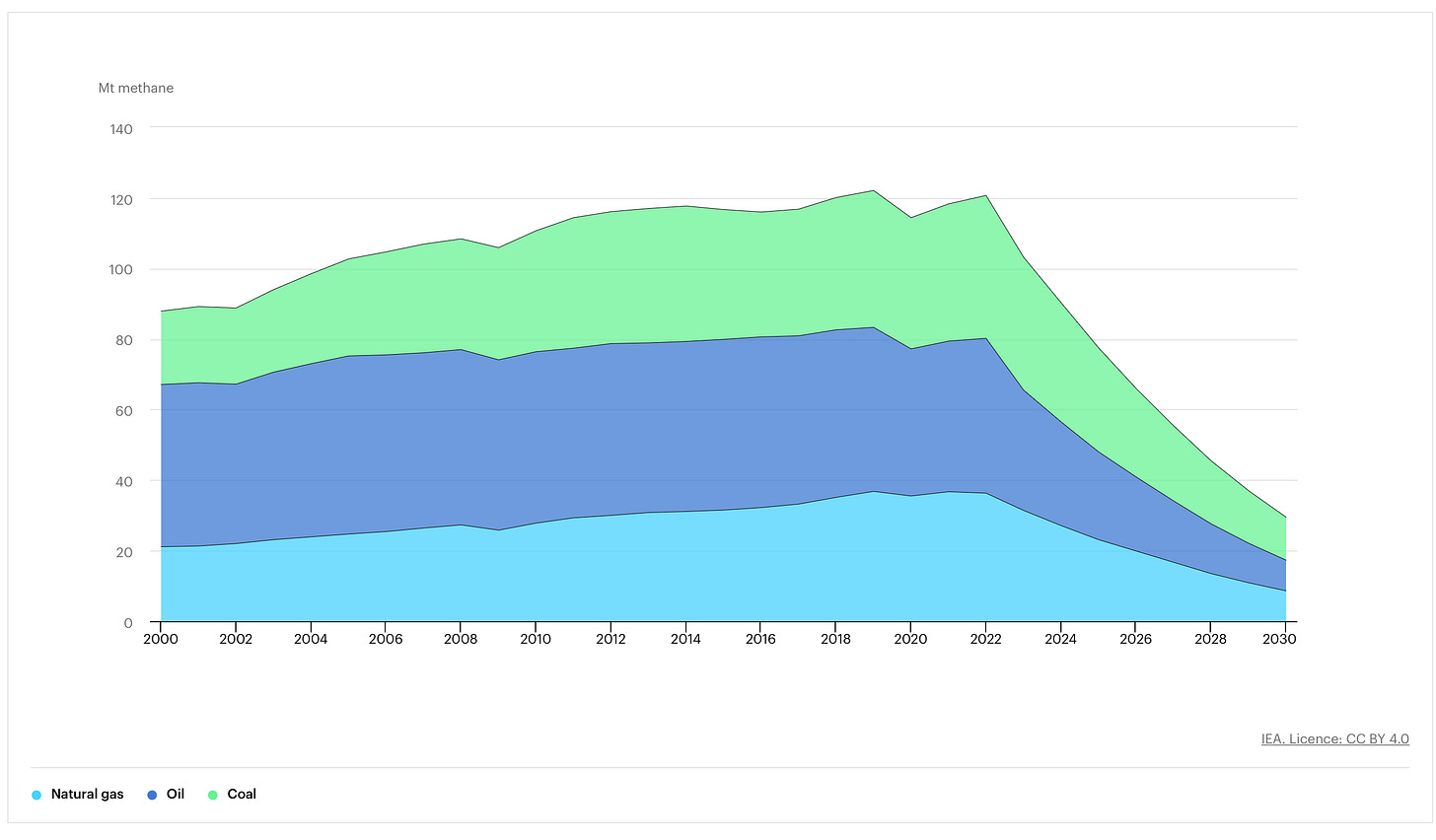

Chart of the week - Reducing methane emissions: very far from targets!

In our “fact of the week” we mentioned how global methane emissions kept rising also in 2022. Here, we wanted to provide a bit more context. A large chunk of methane emissions result from “inefficiencies” in our energy systems, such as leaks in the natural gas networks and by-product emissions in coal and oil’s operations. The latter two industries have historically failed to see the potential of capturing methane and reselling it as an energy source, therefore letting its emissions rise gradually since 2000. As you can clearly see from this chart, under the IEA 2050 net zero scenario, we would need to reduce methane emissions from the energy sector by 75% in the next 7 years… 😩

Company of the week - Tackling the plastic issue

Last week, we spoke about the issue of plastic waste ending up in landfills. This week’s company, Algenesis Materials, started producing fully biodegradable plastic made from algae. The company’s technology got patented: not only it solves the end-of-life problem, but being made from plants, it also solves plastic’s “upstream” problem (i.e. it generally comes from oil). 🗑️

Comment of the week - Removing methane through particles!

Inspired by MIT Technology Review, this week we take a glimpse at iron salt aerosols trying to understand the basic concept behind it and what that means for climate change.

1) What is the iron salt aerosol method?

Greenhouse gas removal technologies are booming in popularity, as scientists/business people start to realize that reducing emissions from current production methods won’t be enough to prevent temperatures from rising. To put it simply, the iron salt aerosol method consists of releasing a small quantity of iron-rich particles into the atmosphere in an attempt to convert methane into CO2. Quoting the MIT, the “iron salt aerosol hypothesis holds that sunlight will irradiate particles such as ferric chloride (FeCl3), producing chlorine radicals that break down methane in the air.

Source: MIT Technology Review

2) Why, if it works, would this be important?

Although the chemical reaction would convert methane into CO2, it would still be extremely effective on a net basis, according to experts. This is because methane exerts about 85 times the warming effect of carbon dioxide over a 20 year period.

3) Who is involved and what is the level of progress?

Plenty of startups are focussing on this technology: examples include Blue Dot Change in the U.S. and Iron Salt Aerosol from Australia. Although the process/technology are not super complicated, we currently are still at the lab stage. This is because not many scientists agree this can ultimately work, citing potential unknown side effects on the atmosphere, oceans and the overall ecosystem.

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!