Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

According to IRENA’s latest report, investments in renewables must quadruple to stay within the +1.5C target established under the Paris Agreement 😬

Hottest news of the week…

Regulation 🗃 – Biden pushing for more EVs sales!

What happened: The Environemntal Prtoection Agency (EPA) has proposed more stringent pollution standards for car manufacturers over the next 10 years, forcing them to sell more EVs as a result. According to the EPA, the new standards will make sure 67% of new light-duty vehicles and 46% of new medium-duty vehicles sold in 2032 will be electric vehicles (EVs). 😮

Zoom out: Biden’s effort to electrify road transports are taking shape! After the $7.5k incentive for EVs buyers, now it is time to “force” manufacturers to sell more EVs! What is missing is a strong EV charging network… however, there is a plan also for this: the administration has set aside $5 billion to reach 500,000 EV charging stations on US roads by 2030! 💪

Business 💰 – BP accelerating decarbonization efforts!

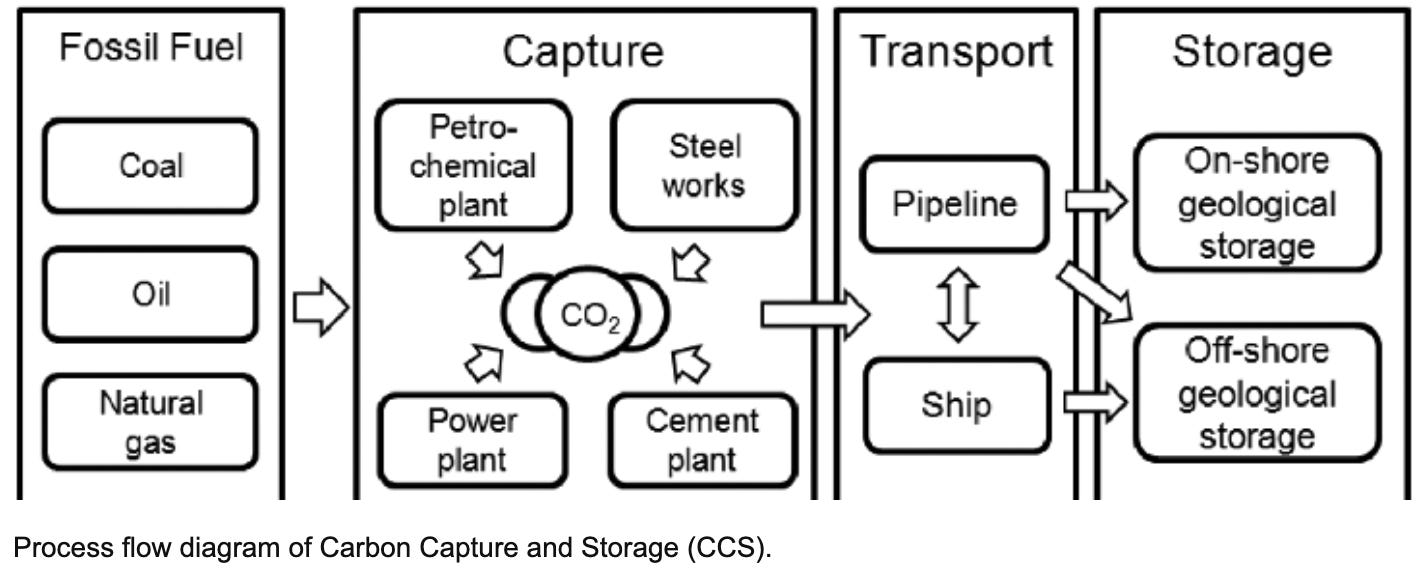

What happened: British Petroleum and Harbour Energy agreed to jointly develop the Viking Carbon Capture and Storage (CCS) project at Humber, England. BP committed to a 40% stake in the project, leaving Harbour Energy to operate with a 60% interest. The CCS project aims to transport CO2 through a newly-formed pipeline connecting emitters in the Humber area to offshore reservoirs that once stored oil&gas. When fully operational, by 2030, the plant is expected to store up to 10 million tons of CO2 per annum. 📈

Zoom out: This project alone would be very meaningful in the UK’s grand scheme decarbonization efforts. Viking alone would achieve 1/3 of the government’s CO2 storage ambitions, which targets 30 million tons per year by the end of the decade. Carbon capture and storage can be used by different industries, from oil and gas to cement manufacturing, and many companies recognize this is the best “net-zero” investment once all the emissions arising from production processes have been tackled. 😎

Innovation 💡 - Europe pushing on battery recycling!

What happened: The Battery Lifecycle Company, a joint venture between TSR Recycling and Rhenus Automotive aimed at managing the whole battery recycling value chain, will be equipped with Europe’s first fully automated system for discharging and disassembling battery modules (the first steps of recycling). This automated discharging system, developed by Bosch with a mixture of hardware and software, increases efficiency and enhances safety: it takes just 15 mins to deep-discharge a battery module, compared to the c.24 hrs needed by the current manual process. 👍

Zoom out: Experts predict recycling capacities for up to 420,000 tonnes of battery material per year will be needed in Europe by 2030. Each year, the Battery Lifecycle Company site will recycle up to 15,000 metric tons of battery materials… The old continent is behind in battery recycling compared to the US, where the battery recycling industry is building momentum, with companies such as Redwood Materials already recycling 40,000 metric tons per year, and a new company with 30,000 metric tons capacity just recently announced. Let’s catch up Europe! 💪

Deep dives of the week…

Chart of the week - Refreshing CCS 🤓

Given carbon capture and storage’s increased relevance, we thought a simple refresher would be of good use. As we discussed in our Business news, CO2 can be captured from different industrial processes. Once captured, it can be subject to onshore/offshore geological storage. The way in which it will be stored determines the means of transport. As one can implicitly notice, development of CCS facilities will depend on land’s geological characteristics… it cannot be scaled easily for every heavy emitting asset globally. The diagram focusses on storage only and excludes usage options once the CO2 is captured (CCU), which in turn would open up many new avenues. 👀

Source: Young-Gyu Park, Research Gate

Company of the week - Hometree, decarbonising homes! 🏠

Hometree, a startup that offers financing for renewable energy solutions for homes, has raised $46m in a Series B funding round to expand its "decarbonisation" financial services. Hometree's business model offers both home cover insurance and financing for decarbonisation services, which allow homeowners to install, manage and finance renewable energy solutions. The funding comes after Hometree recently acquired green home improvement financing platform BeWarm, which mainly offers green loans and leases. The funding round and acquisition marks a significant step towards Hometree's long-term goal of becoming the leading residential energy efficiency platform across Europe! 🚀

Quasi-Deal of the week - Exxon betting hard on Shale? 💰

Exxon Mobil, one of the largest oil player globally, appears to be interested in buying Pioneer Natural Resources, a U.S. based shale company. Reuters’ Robert Cyran takes a closer look at the potential deal and argues it would not make much sense for Exxon… Although, according to his estimates, the deal would be return accretive, he thinks it would not warrant a multiple re-rating. Why? Oil demand has peaked and growth prospects in the industry are limited, according to him. To this end, renewable forms of energy would provide brighter growth avenues and he thinks that’s where Exxon (and other oil majors) should direct their capital. 💸

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!