Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

Environmental groups have sued California regulators over a new rooftop solar policy they fear could suppress the adoption of these clean energy systems. ☀️

Hottest news of the week…

Regulation 🗃 – Norway is back into Oil&Gas

What happened: The Norwegian government has revived plans to explore more hydrocarbons in the Arctic, and executives of major Oil & Gas companies seem to be very happy about that… After a few years of stable / declining drilling, the geopolitical situation led the country to rethink its strategy in order to ensure energy security. The minister in charge went as far as calling further Oil & Gas exploration a “social responsibility” for Norwegian energy companies. Thankfully, geographical limitations may save us some emissions, as the remote location of the Barents Sea, where major untapped reserved might be, make drilling economically unattractive for various companies. 🤔

Zoom out: Norway was trying to diversify away from its glorious Oil & Gas history when Russia’s invasion of Ukraine destabilised the energy landscape in Europe, and is now tempting the Nordic country to establish itself as Europe’s top gas supplier. We cannot blame it all on Norway, as the country’s plans are here to satisfy the demand of other countries, especially Germany and the UK. Despite Norway has reassured that it will carry out drilling in the least harmful way, it does not seem enough to stop harsh criticisms from environmental groups! 😬

Business 💰 – Greenlane, building charging infrastructure 💚

What happened: NextEra Energy Resources, Daimler Trucks and Blackrock have entered into a joint venture to form a heavy-duty charging company. Greenlane, name given to the JV, will focus on designing, developing, installing, and operating the infrastructure. In terms of vehicles, the charging points will be tailored to medium- and heavy-duty battery-electric and hydrogen fuel cell vehicles across the United States. The initial budget for the joint venture is of $650 million; initially, charging locations will be spread across the West Coast, East Coast and Texas. 🚛

Zoom out: While charging infrastructure for electric cars is increasing exponentially in popularity and locations, it is still lagging for heavy vehicles. Not surprising, considering the relative under penetration of electric/hydrogen trucks in the market. Charging infrastructure for electric trucks presents a couple of challenges: 1) Charging stations need to be placed in strategic Locations, given trucks tendency to operate on long and standardized routes 2) Given the size and weight of vehicles, the charging points require higher power and faster charging times.🔋

Innovation 💡 - Daimler showcasing hydrogen trucks🧙

What happened: Daimler showcased demo tours of its CO2 neutral trucks across the Alps. Two prototype variants of the Mercedes-Benz GenH2 Truck with a hydrogen-based fuel cell drive and a near-production-level, battery-electric Mercedes-Benz eActros 300 Tractor for distribution haulage were deployed. A couple of interesting points on the two models: 1) The eActros is already being used in distribution haulage, but is yet to be designed for long-distance haulage. 2) The GenH2 can sustain very long ranges, as it is able to travel up to 1,000 km, ideal for long-haul distances. 🚛

Zoom out: If on one hand, Daimler is partnering with other companies to build a charging network for electric/hydrogen powered trucks, on the other hand it is pushing on developing its own CO2 neutral trucks. Rendering the heavy vehicle industry a net-zero one is not as imminent as for normal vehicles; despite there are some companies out there leading the way, such as Hyzon Motors, the progress being made is still limited on a commercial basis. We find Daimler Trucks’ approach interesting, as it is pushing on both battery-electric and hydrogen powered trucks.📈

Deep dives of the week…

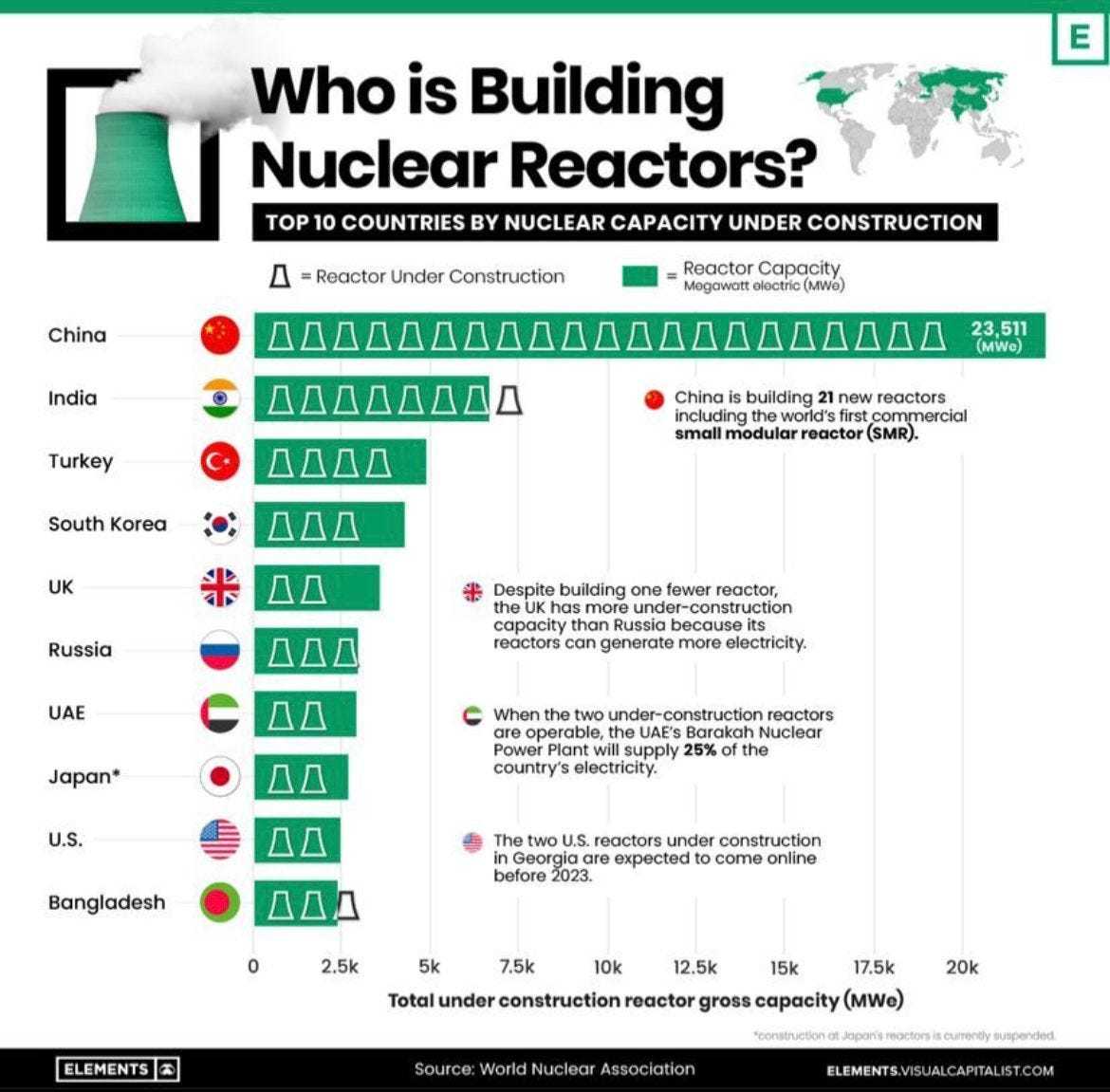

Chart of the week - Let’s make sense of nuclear trends!

We know nuclear is going out of fashion in some European countries, however this is not the case for most of other countries, as we can see from the chart below! Numerous new plants are being built, especially in China and India, the countries where we need it the most! Despite the chart below looks incredibly positive, (for those who support nuclear) the story is not this great... In fact, we need to keep in mind that as reactors are being built, other are reaching their end-life, often due to the expiration of current licenses. In fact, in the period between 2002-2021, the 97 new reactors activated have been offset by 108 reactors retired 😩. However, the future looks brighter for a couple of reasons: 1) Plant life-time extension 2) Increased ease of construction of new plants, also thanks to the innovative Small Modular Reactors (SMRs). The World Nuclear Association in 2021 forecasted 123 reactors closing and 308 coming online by 2040! 🚀

Company of the week - Polymateria, the tesla of plastic? 💣

Polymateria, an imperial College spinout, developed a special ingredient to completely decompose plastic! What is particularly innovative about Polymateria’s tech is that it is compatible with the standard plastic manufacturing process, hence only adding a 10-15% increase in costs, relatively low compared to the environmental benefit. The tech consists in adding a new ingredient which breaks down the plastic in a “wax-type” substance at any time between 6 months and 3 years depending on dosage. For example a plastic bag may be manufactured with a certain level of this ingredient that ensures degradation within 6 months, while a detergent bottle may be produced with a life expectancy of 3 years, to avoid breaking down on shops’ shelves. The start-up has just raised £20m in series B funding which plans to use to accelerate sales and expansion in Asian markets, where plastic pollution is particularly acute! 🙏

Recap of the week - Making sense of top CCUS start-ups! 🤓

As the climate tech sector is growing rapidly and start-ups with millions in funding are everywhere, we wanted to try make sense of the major ones to watch! This week we start from one of the most confusing sectors: Carbon Capture! If you always confuse which companies are doing great in this sector, you are not alone…

Major players in the sector 🚀:

On-site capture: a process that captures CO2 emissions directly where they are generated, e.g. after combustion of fossil fuels in power plants or industrial facilities

Lanza tech: Chicago based carbon capture company traded on the Nasdaq

Carbon clean: UK-based company, very strong in building modular plants easy to set up and run at industrial facilities

Aker Carbon capture: Traded on the Oslo Stock Exchange, they build transportable modular solutions

Carbonbuilt: Start-up using CO2 to create concrete and therefore locking it there permanently

Carbonfree: A Texas based start-up converting CO2 in carbon-negative chemicals

Carbfix: An Iceland based company dissolving CO2 into water and then storing it into the basaltic rock formations

Direct Air Capture: a less popular and less effective process that captures CO2 directly from the atmosphere

Climeworks: Developers and owners of the largest existing DAC plant: ORCA

Global Theromostat: Partnering with various companies, including ExxonMobil, which has invested in the company

Carbon Engineering: Canadian DAC company, which received $110M in funding from prominent investors

Did we miss any cool ones? Let us know in the comments!

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!