Greenify #62: Carbon pricing, battery recycling, and nuclear fusion… can’t get better than this!

May 12, 2023

Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

BNP Paribas, France’s largest lender, has said it will not provide any more lending to the development of oil and gas fields. 👍

Hottest news of the week…

Regulation 🗃 – Indonesia pricing CO2

What happened: Indonesia plans to launch a carbon exchange in the second half of the year, according to Reuters. According to a copy of the document, the carbon exchange will have a cap and trade system where pollution level is limited and allowances can be traded by business entities. Carbon pricing and trading allowances is an important step to net-zero, especially if you consider Indonesia is one of the largest global emitters.🗺️

Zoom out: Carbon pricing mechanisms exist in many developed markets globally. Notably, the European Union was one of the first movers in this sense, when it established its own Emissions Trading Scheme (ETS) back in 2005. The reason regulators price carbon is to ultimately incentivize companies not to release it… in markets such as the EU, emitting CO2 costs a company money, as it needs to buy carbon allowance certificates on the market. Carbon prices in Europe have been floating around €100 in the last year.📈

Business 💰 – Will the largest battery recycling plant be in Italy?

What happened: Glencore, one of the largest commodity trader in the world, with revenues above €250 billion, is planning to repurpose a zinc and lead smelter plant in Sardinia into the largest battery recycling facility in the world... by 2027! 😮 The plant would use hydrometallurgy to recycle Lithium, Nickel and Cobalt from old EVs' batteries, manufacturing scraps and old electronics. The venture should be able to recycle 50K-60K tons per year, 25-50% more than the largest recycling companies nowadays! This capacity would be enough to recycle batteries from 600K EVs per year👍

Zoom out: The Swiss commodity trader wants to capture value in the battery ecosystem, and considers battery recycling a sweet spot! The company already owns 10% of battery recycling leader Li-Cycle and declared that €200-250 million of its EBITDA (currently at €34 billion) already comes from battery recycling! This value is expected to increase rapidly as Li-Cycle predicts that 10% of Lithium demand will be met by recycling in 2030 and as EU legislators ask for a minimum amount of recycled materials to be inserted in in new EVs' batteries by 2030. 🚀

Innovation 💡 - Nuclear Fusion is preparing electricity generation

What happened: Helion, a leading nuclear fusion company, signed its first electricity sale contract this week! The client is Microsoft, which has entered a Power Purchasing Agreement (PPA) with Helium to receive fusion generated electricity in 2028, year in which Helion plans to have a fusion reactor up and running! It is the first time a nuclear fusion company signs a deal to sell electricity, as the technology has not been commercialized yet… however, this deal is a great vote of confidence for fusion, as Helion will have to pay penalties if it won’t respect the agreed terms! 😉

Zoom out: There are more than 30 companies and various governments’ labs currently developing nuclear fusion technologies around the world, according to estimates, and so far investors have poured roughly €5 billion into the technology. However, no venture has generated actual electricity from nuclear fusion yet… Helion plans to do it next year, when Polaris, their 7th generation prototype, will come online! Fingers crossed!🤞

More on Helion in our “company of the week” 👇

Deep dives of the week…

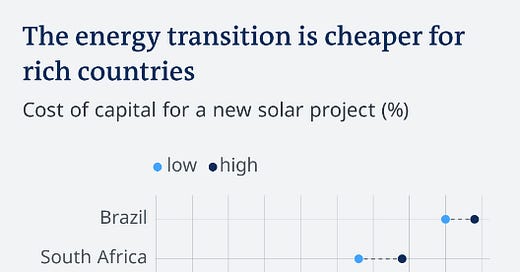

Chart of the week - The cost of transitioning

The chart of the week compares cost of capital for new solar projects for different countries, giving an insight on how easy it is for different countries to transition. In China, costs of financing new infrastructure are lower. Middle-income countries struggle to get loans for projects. In sub-Saharan Africa, where 600 million people do not have access to electricity, finance is particularly hard to come by, according to the IEA. 💸

Source: IEA

Company of the week - Helion, scaling fusion? 🔥

After discussing Helion in our innovation news, we wanted to give you more context on this great company! Helion is one of the leading companies in the nuclear fusion field, and it has raised $570 million of private capital so far. One of its main investor is OpenAI CEO Sam Altman, who provided $375 million in 2021. Next year it plans to be able to generate electricity with Polaris, a new prototype, while recently, it announced it is on track to build the first proper nuclear fusion plant in the next five years! This is a very “aggressive” target with respect to where advancements in the technology currently stand… Experts appear to have doubts around Helion’s targets, but only time will tell. ⌚

Deal of the week - €150 million for fast EV charging!

JOLT Energy, a Dublin and Munich-based Charge Point Operator (CPO) has secured €150m from infrastructure capital provider InfraRed Capital Partners. With up to 320 kW power, JOLT's charging solutions are among the fastest on the market and can be connected to almost any low-voltage AC-grid without major construction work. To do so they combine a charging station connected to the gird and battery storage that provides extra energy to allow up to 100 km of driving range to be charged in five minutes. JOLT will focus on providing charging stations in European and North American cities, mainly in publicly accessible and highly frequented areas such as supermarket parking lots. The company aims to address the lack of sufficient charging facilities for electric vehicles in urban areas where three out of four Europeans live. 💪

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!