Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

Private equity firm Blackstone has raised its investment in Invenergy Renewables up to $4 Billion 💸

Hottest news of the week…

Regulation 🗃 – Europe vs Russia 🚫

What happened: Further, expected, disruption to Europe’s energy markets, as Ukraine’s energy minister German Galushchenko told the FT that one of the last pipelines transporting Russian gas to Europe, through Ukraine, may stop doing so next year. Gas flowing through this route represents about 5% of Europe’s total gas imports, yet Ukraine’s minister said chances of agreeing the renewal of the five-year transit contract first signed in 2019 are very limited. ✍️

Zoom out: Despite a potentially negative short term effect, we think this news is positive when taking into account Europe’s agenda of getting off Russian gas. Although countries like Austria, who received more than 50% of their gas imports in May through this route, might also see negative impacts in the short term, Europe has proven very resilient over the last 18 months in diversifying away from Russian gas by investing into LNG imports. These are expected to rise even further post 2025, according to the FT, as projects launched in the US and Qatar will be supportive.💪🏼

Business 💰 – A $3.3 Billion hydrogen spin off 🫰

What happened: Thyssenkrupp Nucera, a 66-34 joint venture between Germany’s Thyssenkrupp and Italy’s De Nora, is targeting a valuation of at least $3.3bn for its planned IPO in July, according to Reuters. The joint venture, which we had previously mentioned in past editions of this newsletter, specializes in large-scale water electrolyses for green hydrogen production. The latest suggested $3.3bn is below the initially suggested $5bn valuation, just over a month ago, reflecting current investors’ uncertainty on the overall economy. 🤔

Zoom out: Thyssenkrupp is originally a German industrial engineering and steel production multinational conglomerate, with its hydrogen business standing out as the group’s gem. Momentum for green hydrogen, and, more broadly speaking, green technologies is supportive, making it a sensible decision to spin off the business and crystallize value. We think this IPO’s outcome will be very useful in understanding the market’s perception and confidence on hydrogen’s role in decarbonizing the planet. 🌎

Innovation 💡 - Using fin-tech to foster carbon emission incentives!

What happened: Wonder what happens when you use fintech solutions to solve climate issues? Spoiler: you get an innovative and cool idea! That is what a start-up called Crux Climate is doing: using fintech solutions to foster the effectiveness of tax incentives for emission-reducing companies issued by governments. Crux Climate created a marketplace where climate start-ups can sell the tax incentives received which can’t be exploited, as most of these start-ups do not generate profit yet. These incentives can be bought by more mature companies which benefit from the tax reductions. In addition, Crux streamlines collaboration among developers, credit buyers, banks, and other stakeholders. 🤓

Zoom out: If you are already wondering if that is legal, the answer is yes, at least in the US, where there is a clause that allows transferability of tax incentives. This innovation is particularly usueful in the US at the moment, as it is the country with the largest tax incentive, but it might inspire similar solutions in other regions. Tax credits are key in fostering the energy transition, but they favour established power companies over climate start-ups. If this innovation is to take place, it should bring extra financing to early-stage companies that can be invested to cut emissions! 💪

Deep dives of the week…

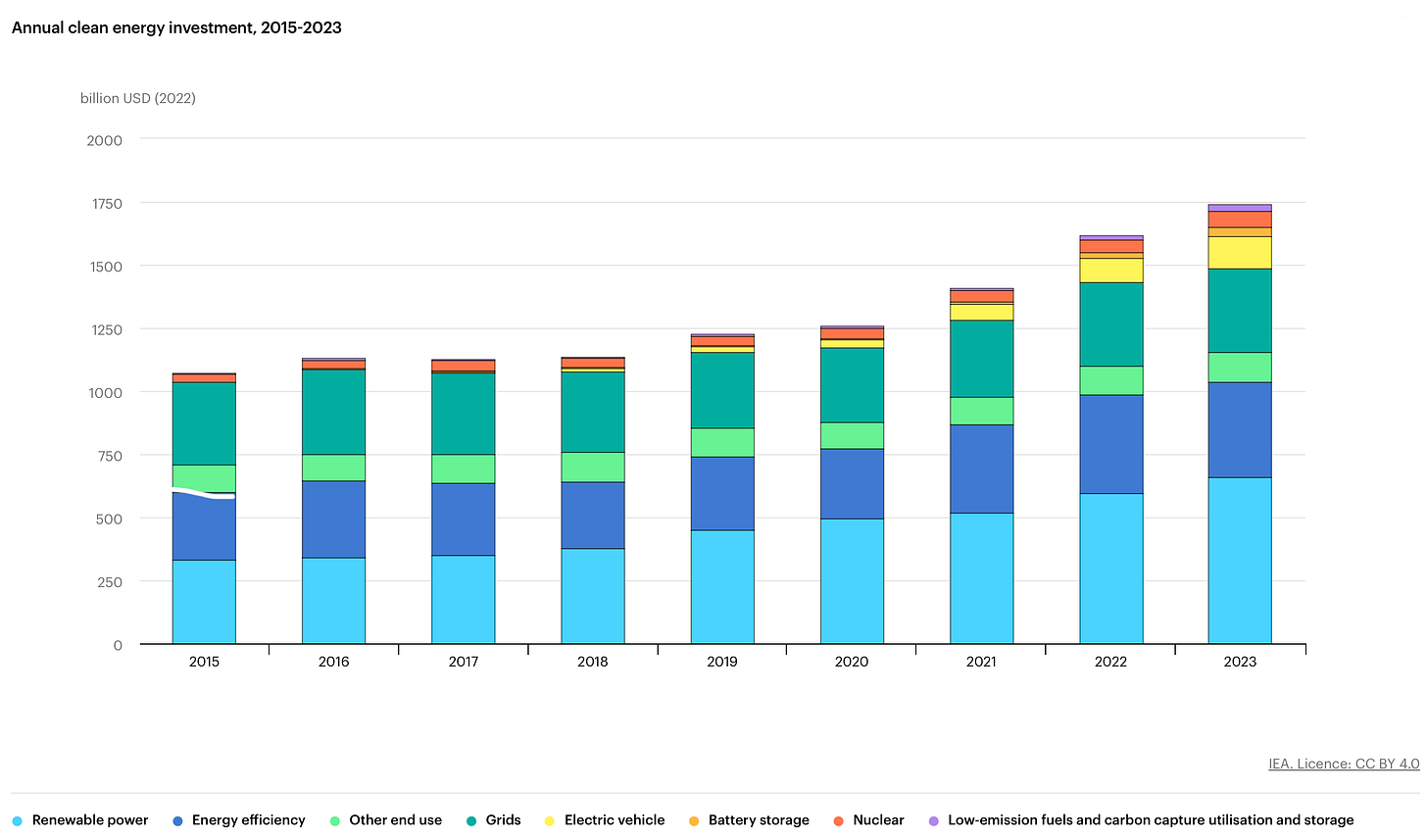

Chart of the week - How are are investments in clean energy doing?

This week we look at the amount of investment in clean energy over the past 8 years. We can see that since 2018, clean energy investments have started to build some serious momentum, particularly driven by investments in renewables and electric vehicles! In 2023 the IEA expects the total amount to reach $1.75 trillion! 😮

Company of the week - Phykos, planting seaweed 🍘

Natural carbon removal technology were discussed on a couple of Greenify editions in the past; we normally focus on trees’ role as natural carbon sinks and, consequently, the importance of avoiding deforestation. This week we introduce Phykos, an ocean carbon dioxide removal company. Phykos cultivates seaweed before sinking it into the ocean.Through photosynthesis, the seaweed will use the sunlight, grow and capture carbon from the atmosphere, a process mimicking exactly that of trees. 🌳

Deal of the week - Money is raining on battery producers 💸

Northvolt, a leading battery manufacturer, has received $400 million in funding from Canada's Investment Management Corporation of Ontario (IMCO). They are known for producing the world's most environmentally friendly battery by using renewable energy in manufacturing and focusing on mineral recovery from battery recycling. This investment will support Northvolt in expanding its production of lithium-ion batteries, with potential applications in heavy transport like trucks and aviation... segments that the company is not willing to give up. Northvolt, valued at $12 billion, is considering an IPO that could value the company at over $20 billion. Their significant valuation is due to raising more than $8 billion in debt and equity since 2017, with investors like BMW and Volkswagen

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!s