Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

Denmark will donate $21.9 million to Brazil's Amazon Fund to fight deforestation.👍

Hottest news of the week…

Regulation 🗃 – The EU doubles down

What happened: The EU’s new green chief, Maros Sefcovic, has vowed not to weaken the continent’s climate ambitions, although it acknowledged the need to better communicate with industries worried about the cost of CO2 abating policies. Sefcovic also discussed the importance of access to funds for European companies, as many of them are fleeing towards the U.S. attracted by generous subsidies schemes under the IRA. 💸

Zoom out: The ambitious goals set by the European Union as part of its Fit for 55 program have not come short of criticisms. In recent months, several countries have openly opposed them, including Poland which argues climate policies will worsen social inequality in the country. As most of these policies require significant investments and look uneconomic, at the moment, critics argue the green agenda will only result in very high long term inflation levels. 📈

Business 💰 – Developing countries are at it

What happened: India’s largest oil and gas producer, ONGC, has said it plans to invest about 24$ billion on clean energy projects with the objective of becoming net zero by 2038. Its investments will range across different “green” initiatives, from installing renewable energy capacity to exploring opportunities in areas such as green hydrogen or green ammonia. 💚

Zoom out: ONGC accounts for about 2/3 of India’s oil production and about 58% of gas. Its 2038 net zero goal looks very ambitious, particularly considering India as a whole only aims to become net zero by 2070, more than forty years later. Overall, it is fairly unusual to see such an important company in a developing country with firm goals on its decarbonization efforts, something we view as a positive and which will hopefully spur others to follow. 👍

Innovation 💡 - Another battery recycling plant!

What happened: On August 24th, giant battery maker Northolt and British recycling firm EMR opened a recycling facility in Hamburg, Germany, where the partners expect to process 10,000 tons of battery packs per year. The first steps of the cycle will be carried out at the Hamburg facility by EMR, while the battery-grade materials will be sent to Northvolt’s facilities in Sweden and recovered using hydrometallurgy. In the near future, Northvolt plans to process 125,000 tons of battery materials annually, meeting about 50% of its cathode production raw material requirements. 🔋

Zoom out: The increasing demand for battery-grade materials and the limited mining output made battery recycling a crucial activity to meet our emissions reduction goals. Although the e-recycling industry is not very mature as there are not enough vehicles that reached end-of-life, companies are investing now to ensure a good market share once the market will be booming! Unsure if the market will be actually booming? Just remember that through hydrometallurgy the recovery rate of battery-grade materials is around 95%…impressive! 🤯

Deep dives of the week…

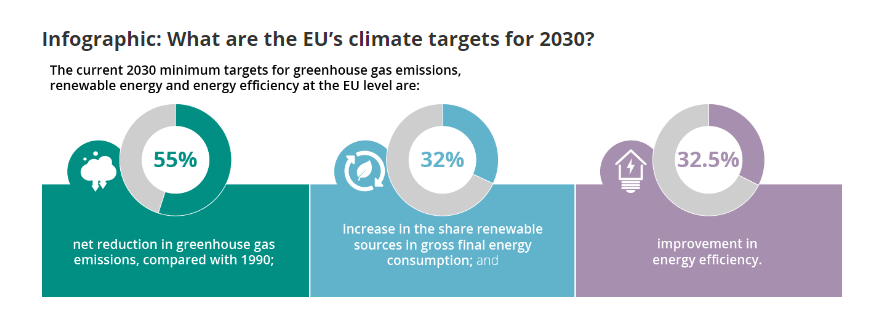

Chart of the week - EU Goals

Quick recap on the EU’s 2030 climate ambitions given recent news around the topic. The three overarching targets are summarized below: 1) A 55% reduction (hence “fit for 55”) in greenhouse gas emissions vs 1990 levels. 2) A 32% increase in the share of renewable sources in final energy consumption. 3) A 32.5% improvement in energy efficiency. 🔋

Source: Europa.eu

Deal of the week - TechMet, investing in the right materials!

TechMet, a startup / fund aiming to ensure a steady metal supply for EVs, energy storage, and green energy projects, has raised $200 million in an equity funding round. Founded in 2017 by Brian Menell, the Dublin-based company invests in assets that produce, process, and recycle technology metals, the essential ingredients of clean energy and EV technologies. The company is set to exceed a $1 billion valuation soon. 📊

It received backing from the US International Development Finance Corporation (DFC), a key shareholder since 2020, as well as new investors like Mercuria Energy, Lansdowne Partners, and S2G Ventures. TechMet's mission focuses on establishing responsible metal supply chains for clean energy advancement. Having invested over $180 million in critical minerals firms like Brazilian Nickel and Rainbow Rare Earths in the past year, the startup is poised for further growth. 📈

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!