Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

According to the IEA, demand for oil, gas and coal will peak by 2030, yet not fast enough to keep global warming within 1.5 degrees. 😱

Hottest news of the week…

Regulation 🗃 – Europe vs China 👊

What happened: European Commission president, Ursula von der Leyen, has announced said the commission was launching an anti-subsidy investigation into Chinese EVs. Brussels thinks Chinese players are distorting the European market by selling vehicles at extremely low prices as they benefit from state support back in China, particularly in the form of subsidies. The EU’s member states, notably France, had been advocating for a move since some time.⌚

Zoom out: According to automotive data analyst Inovev, Chinese manufacturers account for 8% of vehicles sold in Europe at the moment. China is not new to these type of moves, and the EU is not new to these kind of responses; back in 2012, Europe had imposed tariffs on photovoltaic cells to prevent China’s cheap panels from flooding the market. However, back then, tariffs where then removed as the Europe decided to prioritize fast installation of renewable power. Lets see what will happen this time. 😐

Business 💰 – Amazon buying DAC credits ♻️

What happened: This week, Amazon has announced it will be making its first investment in direct air capture technology. The way it will do it is by acquiring 250,000 tons of removal credits over 10 years, generated by a direct air capture plant in Texas owned by Occidental Petroleum. According to DAC technology developers, removal credits currently cost in the mid-to-high-triple digits in dollars per metric ton.💸

Zoom out: The economics of direct air capture currently don’t work, although some argue they will have to eventually work as the only way to get to net-zero is by extracting billions of tons of carbon dioxide annually from the atmosphere. Amazon has pledged to become net-zero by 2040, and is not the only corporate involved in buying these type of credits. Microsoft also signed a similar deal last week with Heirloom, as it committed to buy 315,000 metric tons of CO2.📈

Innovation 💡 - Car makers together to simplify bidirectional charging!

What happened: Ford, Honda and BMW created a equally owned new company called ChargeScape. The company has the goal of creating a platform to make bidirectional charging much easier for EV-owners. Bidirectional charging gives the possibility to EV owners to sell the electricity stored in their batteries to the grid whenever they do not need to use the car. These chargers already exist, but ChargeScape is trying to create a centralized platform that alleviates the need for EV-owners to enter into complex single agreements with their electricity provider! It is good to see EV makers, who compete daily for sales, partnering on such important matters! 👏

Zoom out: A current challenge of the ongoing electrification is how to smooth out peak demand times while maximizing the use of renewable energy. The solution is simple, we need more electricity storage, i.e. batteries. What is not easy is procuring them, that is why the massive amount of EV batteries could come to help! Bidirectional charging is a win-win concept as the car owners benefit from receiving money by selling electricity at peak times, while the overall system benefits from the storage of (hopefully) renewable electricity. Although the concept is very cool, the technology is is struggling to find demand from EV owners… let’s hope ChargeScape will improve the situation! 🤞

Deep dives of the week…

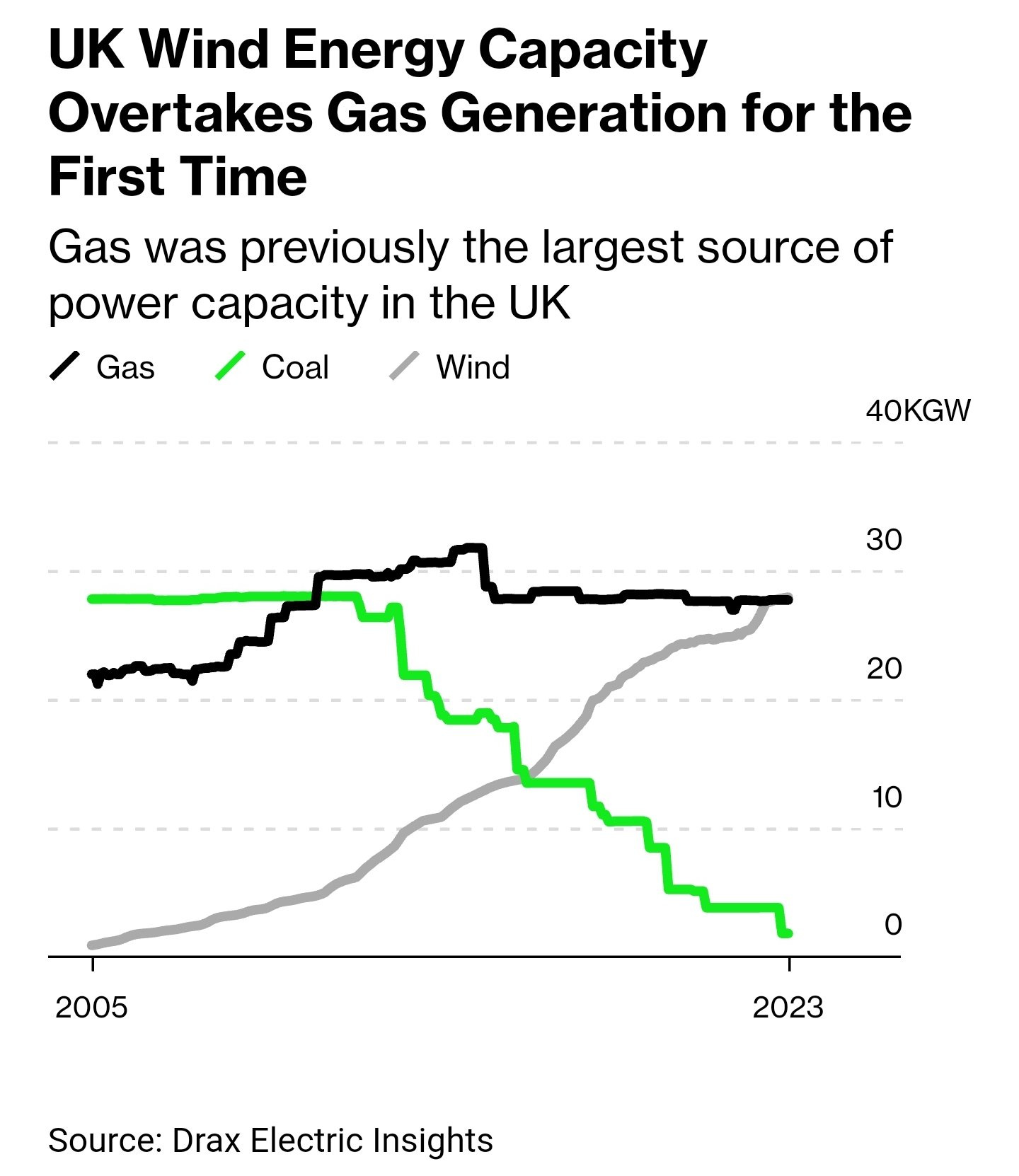

Chart of the week - Wind wins the gold medal 🥇

After a almost 20-years ride, wind power generation became the largest source of power in the UK, surpassing gas! Another amazing trend visible from the graph is the downfall of coal power generation. Keep going UK💪

Deal of the week - One of the largest climate tech fund ever raised!

Galvanize Climate Solutions, a San Francisco based fund focused on climate, has successfully closed a new fund called “Innovation + Expansion Fund” with over $1 billion in investments. The new fund, focused on venture capital (investments in early-art-ups) and growth equity (investments in mature start-up) is considered one of the largest climate venture funds to date. The fund offers not only financial support but also interdisciplinary assistance, such as facilitating priority customer introductions, assisting talent recruitment, etc. to facilitate start-ups’ path to achieving commercial success! 💪

Although this is their largest fund ever raised, Galvanize is not new to Climate Tech, as it has already invested in 11 companies spanning various sectors, showcasing its commitment to driving meaningful decarbonization over the next decade.👏

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!