Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

The US has announced $3.5 billion in grants directed at projects looking to protect and renew the country’s aging power grid.

Hottest news of the week…

Regulation 🗃 – Hydrogen money flowing

What happened: President Joe Biden last Friday announced the final recipients of the $7 billion in federal grants to create regional hydrogen hubs in 16 states. The seven winning projects feature companies like Exxon Mobil and Amazon, with projects focusing on the manufacturing industry supporting job creations. The total investment, including contributions from private companies, is expected to reach $50 billion. These are additional funds on top of subsidies promised under the IRA last year. 🥇

Zoom out: The Biden administration has set targets to increase clean hydrogen output to 10 million metric tons by 2030 and 50 million by 2050, and these grants are definitely working in that direction. The problem is that it seems like these grants will be accessible to companies producing any type of hydrogen, including “grey hydrogen”, derived by methane and therefore a contributor to global emissions. Environmentalist groups are advocating for only “green hydrogen” to be included, while industry groups oppose these stricter requirements, fearing they might hinder overall investment in the sector.❄️

Business 💰 – Major collapse in the e-mobility sector

What happened: Volta Trucks, which makes electric 16-ton trucks for city deliveries, has gone bankrupt as they couldn't get more capital. Volta was a leading start-up in the e-truck space with lot of orders totaling €4.2 billion. Volta was also testing their trucks in several European countries. The bankruptcy was mainly caused by the earlier collapse of Proterra, a California company that made electric buses and batteries on which Volta relied. The collapse of its strategic partner mined Volta's plans to make trucks and scared away potential investors since they couldn't promise a steady battery supply. 🙃

Zoom out: It might seem weird to see a company with €4.2 billion worth of orders and ~€380m of funding received going bankrupt… but this is what happens when you invest in a capital intensive sector and have supply constraints. The bad news is that Volta is not alone, in fact, as reported by Sifted, London-based e-truck start-up “Arrival” has enrolled advisors to get ready for potential insolvency if they can't secure new funding. 😰

Innovation 💡 - Green Bonds: rethinking the credit market

What happened: The Netherlands raised almost €5 billion from the issuance of a new green bond on Tuesday. The proceeds of this issuance will be used to mitigate flooding risks, as the country was already hit badly by floods in 2021, with residents having to leave their homes in some instances. The issuance was a success, as more than €18 billion of bids were received. As a country, the Netherlands has been pioneering green bonds in Europe, with its first green bond issued in 2019. 💸

Zoom out: Financial institutions and corporates have introduced “green” instruments a while ago. The idea behind it is lending money/issuing bonds at a lower interest rates as the proceeds are used to carry out investments which support the planet’s decarbonization across different industries. We think a more fundamental debate is around the “exclusiveness” of these green products… in other words, we wonder if there will be a moment when banks, for instance, will only be able to issue these type of mortgages, and what knock on effects would that have on the economy. 💚

Deep dives of the week…

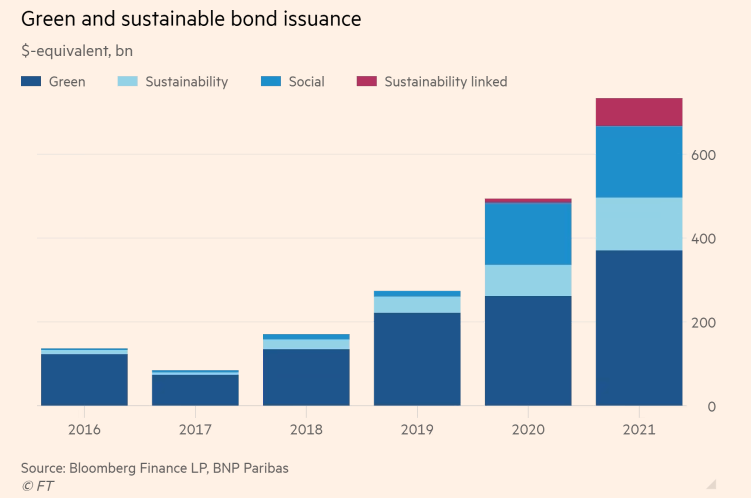

Chart of the week - The rise of green bonds 📈

The market for green bonds has been growing almost exponentially over the past six years. In 2021, according to the FT, sustainability linked issuance constituted about 9% of total issuances, totalling more than $600 billion. Although the rules are still relatively opaque when it comes to defining what a green bond is, we are undoubtedly facing a fundamental shift in how capital is raised globally.

Source: Financial Times

Deal of the week - Biofuels or renewables? This fund has decided to invest in both! 🔋

Copenhagen Infrastructure Partners has successfully closed two new funds: CI Advanced Bioenergy Fund I and CI Green Credit Fund I with a total of approximately €2 billion in commitments. The first one focuses on producing clean fuels, such as renewable natural gas, from organic waste streams, hence mitigating environmental impacts; the second one provides debt financing for renewable energy projects globally, helping to decarbonize the power market and focuses on greenfield and brownfield projects.

The green credit fund has already invested a total of €235 million in three companies, while the Bioenergy fund is at an earlier stage and is currently planning investments in Denmark, the Netherlands, Belgium, and Spain.

Good news for the Energy Transition in Europe! 🌍

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!