Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

The upcoming COP-28, the UN’s conference on climate change, will have a very special guest: Pope Francis himself. Will this help to raise awareness on global warming? We hope so!

Hottest news of the week…

Regulation 🗃 – IRA and solar, an imperfect equation?

What happened: Despite the Biden’s administration efforts to boost local clean energy production through the Inflation Reduction Act (IRA), the solar industry is not seeming to benefit from it. Indeed, despite favorable terms and subsidies to localize production of solar panels, a new wave of Asian capacity has pushed their price at an extremely low level rendering imports more competitive vs local production. 💶

Zoom out: Solar shipments into the U.S. more than doubled through August to $10 billion from about $4 billion a year earlier, and industry representatives in the US are very worried, as this risks to become another strategic industry which the US ends up outsourcing to other countries. The US government did not communicate anything yet on this matter, but we do expect something to change soon. 👍

Business 💰 – Orsted is in pain

What happened: Orsted, the Danish wind king, has profit warned this week with shares falling about 20% in one day. The company had to announce the closure of two wind projects in the US and took a higher write down on its portfolio than what it originally expected. Orsted’s management team spoke about the need to think about ways to support its capital structure and focussing on projects which only add value to the company’s portfolio. 🌬

Zoom out: The wind industry, as we discussed in previous editions, is suffering from large supply chain issues coupled with an underlying weak market, as high interest rates are making it harder for the economics of wind projects to work. Orsted is not alone though… BP has also booked a $540 million write down on two offshore wind projects off the New York coast this week. Aside from supply chain and interest rates, people familiar with the industry also point to permitting issues which tend to delay most of these projects. 💵

Innovation 💡 - CO2 storage, a necessary piece of the puzzle?

What happened: One of the largest carbon storage basins in the world is about to go live in Italy, just off the Adriatic coast! This will come from a JV between Italian energy giants Eni and Snam, which are repurposing depleted gas fields to store captured CO2! Although the plan was announced at the beginning of the year, implementation is happening now, making the infrastructure ready to receive CO2 produced by ENI from 2024. From 2026 onwards, the storage basin is open for business with other industrial emitters and is expected to reach an annual capacity of more than 16m tonnes by 2030. Snam’s CEO, Stefano Venier, also invited industrial emitters from northern European countries to consider the Adriatic basins for their sequestration purposes! 💥

Zoom out: Carbon Capture and Storage (CCS) is probably the most controversial technology in the energy transition space. Although its benefits are intuitive (it is literally taking CO2 that would otherwise be emitted and storing it underground forever), various experts in the field are against it. The reason? It gives an incentive and a justification to large emitters to keep doing business as usual, thinking that CCS can solve the problem without the need to decarbonize their operations. Both parties have a point, but as decarbonizing heavy industries will take decades, CCS is a must. 😎

Deep dives of the week…

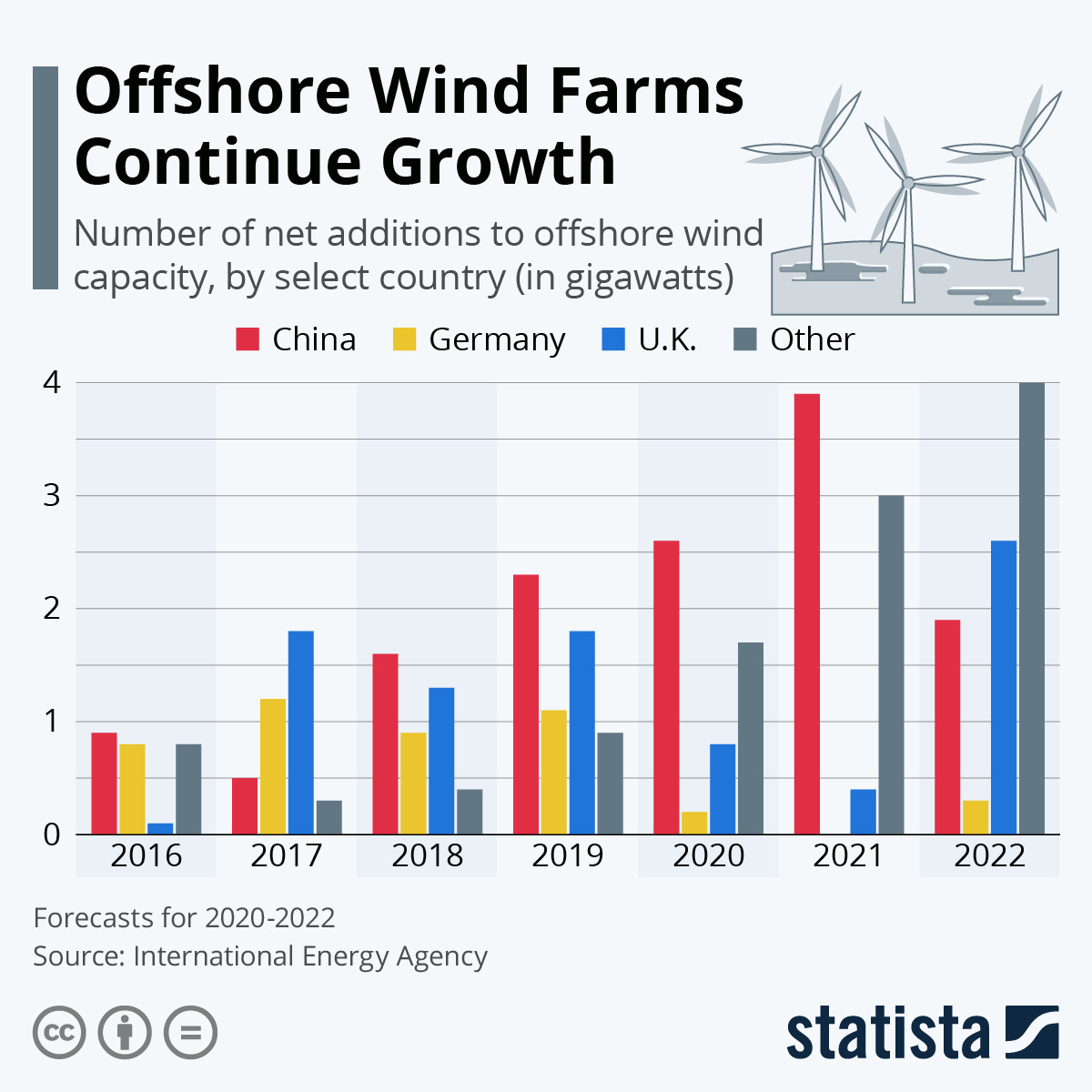

Chart of the week - Offshore wind recap

Offshore wind’s growth has been significant, although the pace of the acceleration is coming under pressure. 2022 marked the first year since 2017 in which China, one of the world’s largest wind developer, recorded a deceleration in new net gigawatt additions. From here the path looks complicated for the industry, as some experts are insisting on a large reset needed.

Source: International Energy Agency

Deal of the week - Ola Electric, decarbonizing transports in India!

This week we are traveling to India to tell you about the largest deal of the week in the energy transition space. We are talking about Ola Electric, India’s largest electric scooters manufacturer! Ola electric manufactures and sells efficient e-scooters at an affordable price (starting from ~€1k). However, the company now wants to expand upstream by setting up a battery manufacturing site!

To do so, it has just raised the equivalent of ~€350 million from Temasek (Singapore’s national fund) and the State Bank of India! This is not it, as sources are saying that the company, which is currently valued around €5 billion, might go for an IPO in the next months…Stay tuned! 🇮🇳

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!