Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Facts of the week

Sad fact: We are still waiting for a much-needed package of regulations on methane emissions coming from COP 28.

Consolatory fact: Six of the world’s largest dairy companies have pledged to disclose the amount of methane they produce.

Hottest news of the week…

Regulation 🗃 – Canada pricing carbon

What happened: The Canadian government is proposing a cap-and-trade system for the oil and gas industry in an attempt to slash the sector’s emissions. A cap-and-trade system is essentially a tool which puts a price on CO2, preventing the companies from emitting over a set limit, or alternatively forcing them to pay a price for each ton of CO2 exceeding that limit. A carbon price is not a new concept; the EU, for example, launched its Emissions Trading System (ETS) back in 2005, targeting emissions reduction in the “hard-to-abate” industries. 🛢️

Zoom out: Canada is the world’s fourth largest oil producer, with oil and gas emissions accounting for over 25% of the country’s total CO2 emissions. Pricing the industry’s CO2 is a very controversial plan, as local governments whose economies rely heavily on oil fear this move could worsen their competitive position. Alberta’s recently elected premier, Danielle Smith, has already pushed back on the proposal. ⛔

Business 💰 – EV war in India?

What happened: Competition is heating up in the Indian EV market. Tata Motors, India’s largest automobile manufacturer, is lobbying the country’s government not to lower import taxes on electric vehicles (currently at 100%). Tata Motors argues the EV domestic industry needs to be protected, but most importantly, fears Tesla’s entry in the market. The US automaker has recently proposed to set up an Indian factory, yet in return it is demanding lower import taxes on other EVs, in an effort to penetrate the high growth Indian market. 🚗

Zoom out: Electric vehicles are still at an embryonic stage in India. Approximately 3 million cars are sold in India each year, with EVs accounting for about 100,000 only, less than 5% of the total. Of that 5%, Tata holds a dominant market position, accounting for 72% of total EV share. Tata, backed by investors who were banking on the 100% import tax to hold, could face structural and funding issues should Tesla break in the market. Ultimately, if the Indian government intends to boost EVs adoption, we think Tata is not in a safe position. 🕰️

Innovation 💡 - Carbon removal coalition bets on enhanced rock weathering

What happened: Frontier, a coalition of tech and financial companies whose goal is to purchase carbon credits, has just announced a big agreement with an innovative carbon removal company. Frontier will buy carbon credits worth ~ €50 million from Lithos Carbon, which in exchange promises to remove more than 150,000 tonnes of CO2 from the atmosphere through 2028. The company will do so by using a relatively innovative technique, known as enhanced rock weathering (ERW). The amount Lithos promises to remove in 4 years is enormous…curious to see if they can meet their target. 💪

Zoom out: We talked about ERW before, while assessing another deal from Frontier in Greenify #64… yes the love story between frontier and ERW is not new, although this is their largest deal by far. Rock weathering is a process which occurs naturally when CO2 in rainwater interacts with silicate rocks, the CO2 mineralizes, and it is safely stored as solid carbon for hundreds of thousands of years. ERW utilizes crushed basalt rock and spreads it on agricultural land to accelerate the natural process. 🙌🏻

Deep dives of the week…

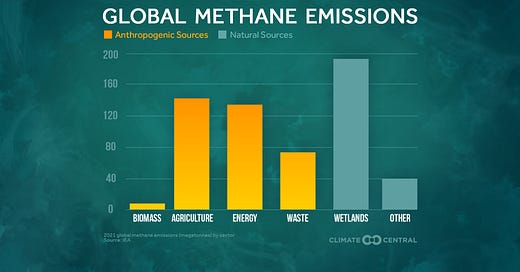

Chart of the week - Where do methane emissions come from?

As mentioned in the fact of the week, no serious deal on methane emissions has been reached so far at COP 28.

However, as flagged also by The Economist last week, this deal is very much needed, as methane has more than 80 times the global warming power of CO2 (although it sticks in the atmosphere for a shorter period of time).

Given cutting methane emissions is one of the most impactful actions we can take in the short term, we thought it was useful to share where these emissions come from. As you can see from the chart below, more than 60% are human-caused, and among these, agriculture plays the largest role. Within the agricultural sector, cattle farming plays a large role. Therefore the agreement signed by the major diary producers at COP 28 is encouraging.

Deal of the week - KKR’s new climate fund

Private equity giant KKR has been rumoured to be in the process of raising $7 billion for the opening of its first global climate fund. KKR, which has upped his climate game in recent years through external hires with significant industry experience, is targeting to close the fund in the first half of next year.📈

According to Reuters, investments will be focusing on a broad range of technologies, from energy storage to the transportation industry. Investment tickets are expected to range between $300 million and $750 million, with KKR looking for investment opportunities across Europe, Asia Pacific, and the US.🗺️

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!