Welcome to Greenify 😃!

Did a friend send you Greenify? Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

📌 Fact of the week

The EU and European Council came to a preliminary agreement on a voluntary framework for the certification of carbon removals.🤝

Hottest news of the week…

Regulation 🗃 – Germany’s hydrogen ambitions

What happened: Germany has earmarked up to $3.8 bn for future green hydrogen imports. The government has set apart this amount of money to procure green hydrogen and its derivatives between 2027 and 2036. According to the government’s last hydrogen strategy report, published last summer, Germany will have to import up to 70% of its hydrogen needs in the future. As a reminder, the country wants to become carbon neutral by 2045. 🇩🇪

Zoom out: Germany is an industrial powerhouse, home to Europe’s automobile industry and a key country in hard to abate sectors such as steel or chemicals. These are sectors which cannot easily be electrified, hence hydrogen looks like the most appropriate solution should Germany want to get to net zero. Whether hydrogen is an economically feasible solution is another important issue; as of today, the cost of generating power through hydrogen makes it look prohibitive vs fossil fuels, although through incentives, scale and fossil fuel associated penalties things might change.🎖

Business 💰 – The American EV industry is in troubled water!

What happened: Rivian, a prominent US EV manufacturer saw its stock price fall by ~25% on a single day, after it cut its sales forecast for 2024 and announced new layoffs that will affect 10% of its workforce. The company was expecting to sell ~80k vehicles in 2024, but it recently reduced this figure to ~55K, amid an overall crisis in the American EV industry. Rivian is focused on trucks and SUVs, and the fact that it has been burning a lot of cash in the development of its latest models is not helping… maybe shifting to smaller and cheaper EVs could help?🔋

Zoom out: As mentioned, Rivian is not the only US EV maker swimming in troubled waters… Elon Musk himself raised concerns on the status of the industry, which is suffering from a prolonged period of high interest rates. Also Lucid, another EV maker, cut its 2024 vehicles sales forecasts significantly, despite having recently reduced the price of its models! The IRA is currently not having such a big impact on EV sales as people were hoping for… is it just a temporary crisis or is it here to stay? Only time and some LinkedIn Gurus will tell! 🏎

Innovation 💡 - Offshore Wind in the US

What happened: The first offshore wind farm in the US is successfully powering more than 30,000 homes. As we mentioned in previous editions, the US government is placing bets on its offshore wind industry, despite all the issues the industry faced in the last 24 months in terms of soaring costs and delays. Governments are also increasingly looking at the next leg of innovation, which consists of floating wind farms. As of 2023, there are only 4 operational floating wind farms globally. 💨

Zoom out: Vineyard Wind is the first large scale U.S. offshore wind farm. If we take a look at the largest offshore wind farms globally, we notice the UK is up there: the five largest operational offshore wind farms in the world are all built off the UK coast. The largest one, “Hornsea Project Two” has a capacity of 1,386 MW and consists of 165 turbines. The Netherlands also rank quite highly, with three offshore farms in the top 10 list.🇬🇧

Deep dives of the week…

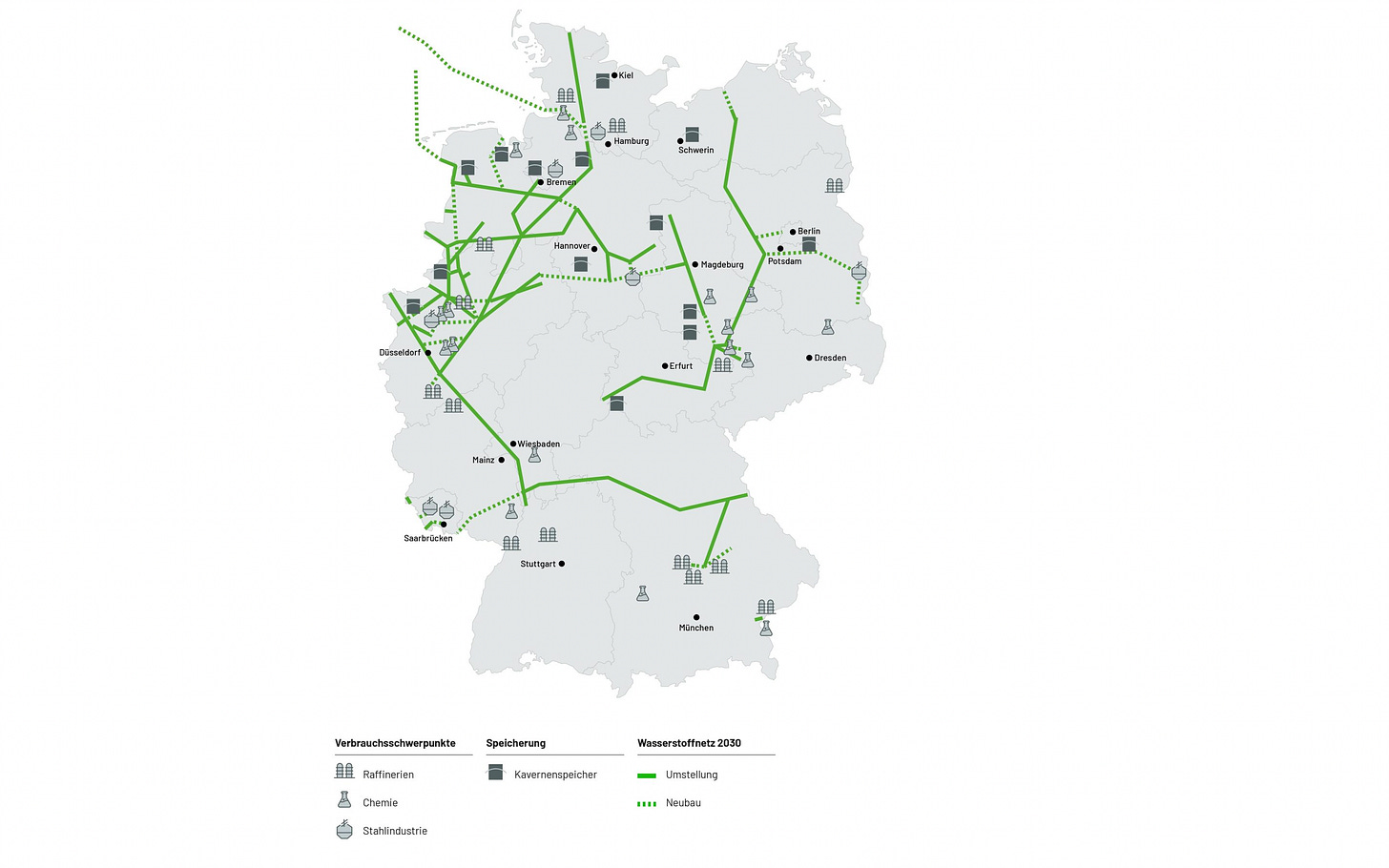

Chart of the week - Germany’s hydrogen network

In our regulation news, we talk about Germany’s hydrogen plans to become carbon neutral by 2045. Below an interesting schematic illustrating how the country is thinking about adjusting its infrastructure to favor the clean fuel’s penetration.🕸

Source: FNB Gas

Deal of the week - Recycling batteries in the UK

Altilium, a British start-up developing proprietary technology for battery recycling, has just raised ~€10 million in a Series A round. The money comes from the corporate venture arm of SQM, one of the world’s leading producers of battery-grade lithium.

Altilium has been developing its technology for some years, enhancing its proprietary EcoCathode hydrometallurgical process to shred used batteries. It now plans to use the raised funds to build two recycling facilities. The first will be a mini-commercial facility in England to shred batteries and produce black mass, while the second will be in Eastern Europe and will process black mass into materials ready for new batteries! This second facility represents a huge news for the European market, as black mass processing is usually done only in China!

The company is also thinking about building what would be the largest UK battery recycling facility, located in Teesside… but this will inevitably require more money and time! Best of luck Altilium!💰

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!