Welcome to Greenify! Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

54% of projects extracting clean energy minerals overlap with Indigenous lands, according to recent research conducted by Phys.org 😬

Hottest news of the week…

Regulation 🗃 - Green trade war?

What happened: French finance minister, Bruno Le Maire, thinks Europe should also look at similar ways to boost its green industry in response to the US’ Inflation Reduction Act (IRA). The latter has been criticized by EU member states as the US government will provide generous tax breaks for components used in renewable energy technologies, as long as they are produced in North America. Essentially, the EU is worried this will incentivize companies to escape Europe and establish production hubs in the US. 🥷

Zoom out: From a regulative standpoint, Europe has always been ahead of the U.S. on sustainability policies. However, the Inflation Reduction Act (IRA), which we originally discussed in Greenify #27, represents a crucial milestone for the US. The interplay between public and private markets efforts (i.e. who should pay?) in the energy transition debate will be a key issue determining how the EU will tackle this problem. 💸

Business 💰- BP: leveraging the hydrogen opportunity

What happened: Oil giant British Petroleum (BP) is reacting to large incentives offered on hydrogen production under President Joe Biden's $430 billion Inflation Reduction Act (IRA). The company has created a dedicated hydrogen division, and is building a low-carbon hydrogen hub around its Indiana refinery, as well as investing across Europe and Australia, looking to develop green hydrogen in Oman and looking into projects in Mauritania.💚

Zoom out: Hydrogen can be grey (produced by heating natural gas), blue (same process as grey but with carbon capture included) or green (produced by splitting water molecules using renewable energy). According to Reuters, Biden’s IRA offers a $3 per kilogramme tax credit for green hydrogen, making it cost competitive with grey and blue hydrogen and hence attractive for companies. Still, according to Reuters, BP might unveil clean hydrogen production targets in February 2023. Stay tuned!📈

Innovation 💡- Australia’s first green hydrogen refueling station

What happened: Fortescue and ATCO Australia partnered up to open Western Australia’s first green hydrogen refuelling station. Green hydrogen is supplied from ATCO’s facility nearby, and will be used to support the companies’ fleet of hydrogen fuel cell vehicles. ⛽

Zoom out: Fortescue, an iron ore company, is betting on renewables through its green branch Fortescue Future Industries (FFI). Fortescue’s CEO Andrew Forrest said he plans to invest 10% of the group’s after-tax profits into FFI in order to speed up the transition. Concretely, Fortescue has started betting on hydrogen already: earlier this year, for example, it has signed a memorandum of understanding with German utility company E.ON to develop a hydrogen supply chain between Australia and Germany. 🥇

Deep dives of the week…

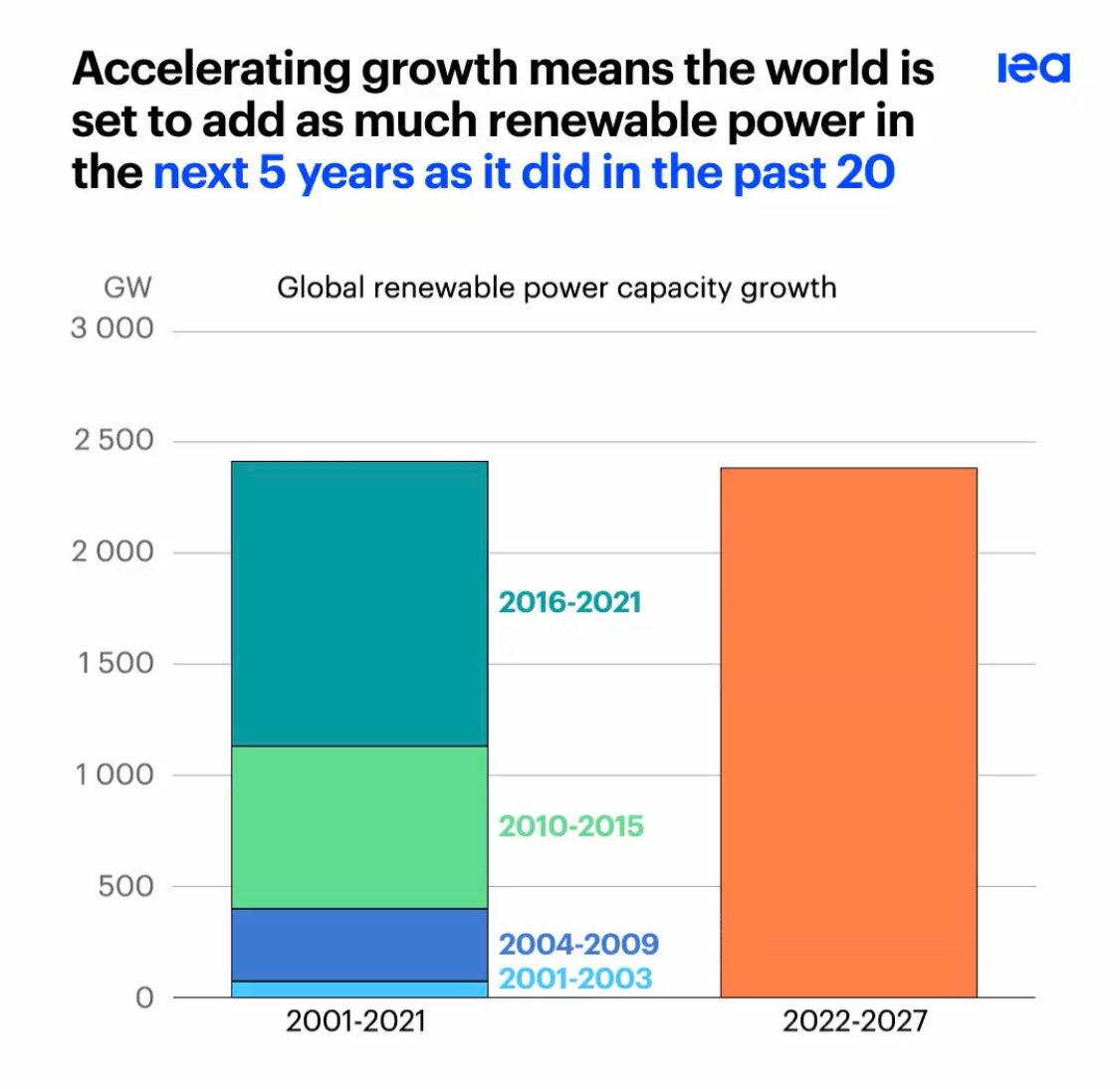

Graph of the week - Renewables momentum?

The International Energy Agency (IEA) just published its “Renewables 2022” report, where they assessed the current and unprecedented momentum for renewables! The IEA’s complex models now estimate that renewable capacity expansion in the next 5 years will equal the capacity added in the past 20 years!😮 And yes, we have to partly thank Mr. Putin for that, as this forecast is 30% higher than IEA’s estimate pre Russia’s invasion of Ukraine. Let’s keep going 💪

Company of the week - Noriware, zeroing packaging issues

Plastic waste represents one of the biggest threats to our planet. According to National Geographic, 40% of all plastic produced is packaging, used once and then discarded. This is where Noriware steps in! This green tech startup produces sustainable packaging films from renewable resources, such as algae. Being made from 100% natural materials, Noriware’s packaging films decompose, just like food, alleviating the landfill waste issues caused by traditional plastic. 📦

Comment of the week - H2 transportation: here comes the problem!

We close this hydrogen-intense edition on a more negative note, after the two encouraging news of the week. In fact, by reporting the findings of a recent paper published by Philipp Jäger, we want to talk about the difficulties related to hydrogen transportations and what Europe should do to overcome these:

What’s the current situation? 🧐

Green Hydrogen is considered by many the best solution to decarbonize energy intensive industries that cannot be directly electrified, i.e. it is a very good substitute for natural gas in industries

Unfortunately, Europe cannot generate large amount of cheap green hydrogen, due to its relatively unfavourable geographical conditions

Therefore, Europe plans to import large quantities of green hydrogen from regions with better wind and solar potential (e.g. Africa for solar)

However, transportation costs for hydrogen are very high due to its intrinsic properties that make it hard to liquefy (-253°C) and also impossible to transport through current gas pipelines, unless they undertake expensive renovation interventions

What can the EU do? 💡

Making Hydrogen transportation within the EU as cheap as possible, by building a hydrogen pipeline network . This would involve a large capital expenditure but would reduce hydrogen transportation costs in the long term

Develop an hydrogen strategy taking into account the transportation costs, hence considering to:

Import hydrogen from favourable neighbouring countries rather than far away ones. For example, the cheapest option for Europe imports would be North Africa, once the production in the region scale up

Create hydrogen pipelines or adapt existing ones to exploit the cheapest form of transportation in the future

However… 😬

Unfortunately, there doesn’t seem to be an easy solution to the high transportation costs, and at the moment it is cheaper to produce materials like green steel in the regions with high renewable capacity and then transport it as a finished good to Europe

Therefore, some European industries are at risk of losing their relative competiveness in the post fossil-fuels era… (more on this point from the ft)

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!