Welcome to Greenify! Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

Swedish mining company LKAB has found Europe’s biggest deposit of rare earth metals… not bad! 🥇

Hottest news of the week…

Regulation 🗃 – The EU-US dispute will have a sequel

What happened: In Greenify #41, we reported news surrounding a potential EU collective response to the US’ Inflation Reduction Act (IRA). According to Bloomberg, it looks like the matter is getting serious… German chancellor Scholz and his political party (SPD) are pushing the EU to reform its legislation around state aid rules in order to support green technologies. Particularly, the focus seems to be on batteries, green hydrogen and deployment of green technologies. 🔋

Zoom out: In order to preserve its leadership on clean tech innovation, we think it is paramount for Europe to “respond” appropriately to the US. When it comes to capital invested, for a variety of reasons (including favourable regulation), the pattern for the last 15 years points to outflows for Europe and inflows for the U.S. As Europeans, we don’t want to get to a scenario where our clean tech innovators escape to the U.S. Although we understand the EU’s balance sheet is quite stretched following its efforts throughout the pandemic, we are still hoping for a happy ending. 🙏

Business 💰 – Insurance struggles with global warming

What happened: $120 billion is the amount paid by insurance companies in 2022 to cover losses from natural disasters! This is a huge increase vs. industry norms of maximum $50 billion for natural disasters before 2005! This insurance industry “niche” is growing, with insurance companies collecting huge premiums from worried countries, corporates, and households. However, insurance companies are struggling to keep up with the $100+ billion of regular losses paid per year. 😱

Zoom out: What’s worse is that these huge figures do not take into account uninsured losses, which are way larger and often hit developing countries. That is why at COP 27 the focus was to create a fund for industrialized nations to repay the damage faced by developing countries such as, but not limited to, Pakistan. Now, we understand why developing countries are asking for hundreds of billion to be poured in this fund! 💸

Innovation 💡 - Off-shore wind is getting bigger!

What happened: Wind turbines producers are racing against each other to produce the largest turbine possible! GE Renewable Energy recently developed a wind turbine certified to operate up to 14.7 MW! This is currently the most powerful turbine in the world, but it won’t last for long as a Chinese manufacturer CSSC Haizhuang has just unveiled a prototype for a 18 MW offshore wind turbine! This monstrous turbine will have 128m long blades! 😮

Zoom out: Off-shore turbines are more efficient than normal on-shore ones. This is because winds are generally stronger and steadier in open waters. In fact, one of these CCSC 18 MW wind turbines could power up to 40,000 houses, an impressive figure in the renewable space! Off-shore turbines are also less visually impactful and therefore it easier to build larger farms; however, important constraints are the difficulty in building and maintaining them as well as their impact on the marine ecosystem. That is why some companies are focusing on floating off-shore turbines, easier to build and maintain, which we will explore soon in one of our next editions…👍

Deep dives of the week…

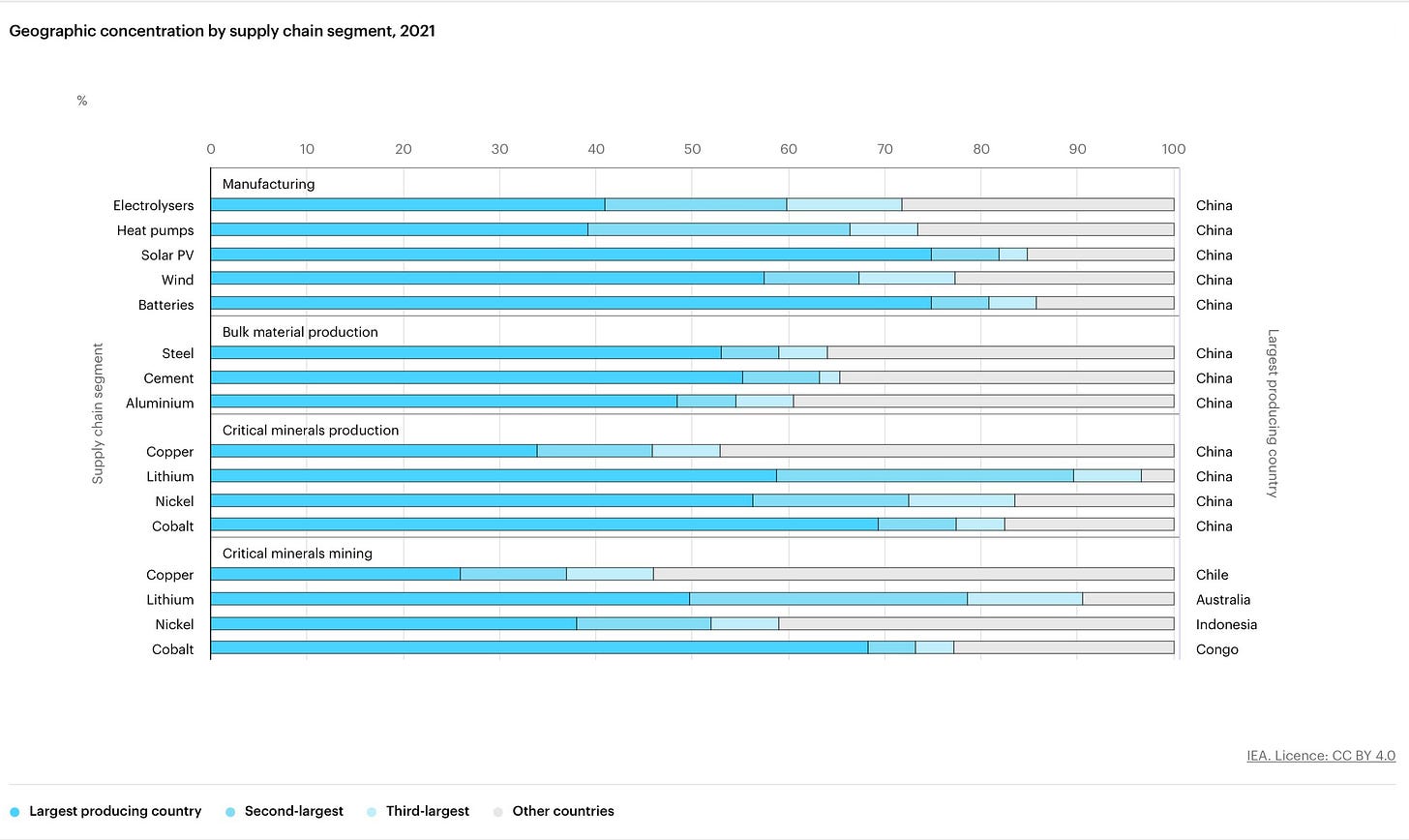

Graph of the week - China dominating the energy transition!

The International Energy Agency (IEA) has published the “Energy Technology Perspectives 2023”, exploring the biggest tech trends in the energy transition. We recommend you take a look as it is pretty insightful…. What we can anticipate to you is that all the fundamental materials/components behind these trends have one feature in common: they are all geographically concentrated, with China leading by far in almost every production process 😬

Company of the week - Brimstone: carbon negative cement? 💡

If cement, were a country, it would be the third largest emitter in the world. Accounting for c.8% of global greenhouse gas emissions, cement is a major responsible for global warming yet a necessary pillar for economic development. According to Brimstone, there is a way to solve the warming problem: 60% of CO2 emissions from cement production are released when heating limestone, the main rock used for the material production… By using calcium silicate rock instead of limestone, Brimstone claims it can get rid of these emissions. The remaining 40% of emissions, so called thermal, come from the fuels used to heat these rocks. Here, fixing the problem is “easier”, as it simply involves substituting fuels like coal or petcoke with alternatives and biomass. Lets see where the “Brimstone Process™” will get to. 😎

Comment of the week - Powell taking distance 🤔

Source: AP News

In a speech in Stockholm on central banks’ independence, FED chair Jerome Powell has spoken about the limited role the FED should play in fighting climate change: “Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals (…) We are not, and will not be, a climate policymaker.” Powell emphasized, once again, his main job is maintaining price stability in the economy… well, considering the 2022 outcome, we would say there is scope for improvement there. This stance differs from the European Central Bank (ECB), who, as part of its mandate, can fight climate change through policies aimed at, for example, restricting bank financing towards fossil fuel projects. 👮♂️

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!