Welcome to Greenify! Subscribe now and thank us later for not missing the most insightful information on the booming #GreenTransition!

Please help us improve by leaving a comment or feedback, and if you like what you are learning… share it with your network 😁!

📌 Fact of the week

For the first time in a decade, people without access to modern forms of energy are growing. About 75m people who recently had gained access to electricity are likely to lose it due to the high prices, according to the IEA.

Hottest news of the week…

Regulation 🗃 – Germany, what are you doing?

What happened: In an “emergency” effort to counter the Russian energy crisis, the German government has granted permission to extend a lignite (coal) mine near the condemned village of Luetzerath. For context, when burned, lignite releases more planet-warming carbon dioxide than any other form of coal. This decision wasn’t greeted positively by climate activists, who occupied the area and were later escorted out by police forces.❓

Zoom out: Many eyebrows were raised following this decision. We find it hard to conceive how expanding a coal mine can be the best solution. The German government is citing an “emergency” condition due to a shortage of alternative sources, yet it will actually take several months to develop the coal reserves and burn them for energy production. Combined with Germany’s intention to phase out nuclear power, this decision is even harder to understand.🤔

Business 💰 – Shell diversifying into EV chargers

What happened: Shell USA, the North American subsidiary of the Oil&Gas giant, is buying Volta, an innovative developer of EV charging infrastructure for $169 million. We said innovative because Volta’s stations are actually free of charge! The chargers are located in key areas (e.g. outside grocery stores and shopping malls) and revenues come from advertisements shown on a large display! The company is mainly present in the US, totalling 3K active points and other 3.4K in the pipeline. Hopefully Shell can resolve Volta’s recent financial constraints and continue its worldwide expansion!

Zoom out: You do not have to be a business genius to understand why Shell is buying it: a company that owns thousands of fuel stations is trying to diversify into EV charging, following the rapid increase in EVs’ sales. In fact, it is not first deal of this kind, Shell previously bought Ubricity, Greenlots, Newmotion, and other e-mobility businesses, totalling 90k charging points directly managed and other 30k through partnerships. The company aims to run 500k EV charging points by 2025, but will face competitions from other Oil&Gas companies like BP, Total and EDF, which have been investing in EV charging assets too.

Innovation 💡 - Breakthrough battery technology

What happened: The MIT Download recently featured battery recycling as one of its top 10 breakthrough technologies for 2023. The main recycling method for lithium-ion batteries (those you would find in an EV) is called hydrometallurgy. This is a process by which materials in the batteries are dissolved and separated using a range of acids and solvents. This way, precious materials such as nickel, cobalt, graphite, copper and lithium can be recovered and reused. ♻️

Zoom out: If we take a global approach to the matter, this innovation becomes extremely interesting. If future EV penetration estimates are correct, EVs will represent 30% of new vehicle sales by 2030. Therefore, the need for batteries will be massive… according to Benchmarkingminerals.com, more than 300 new mines would be required to meet battery demand by 2035. Problem is, like all materials, supply is limited. So battery recycling perfectly fills this gap. Find out more in our Company of the Week! 💡

Deep dives of the week…

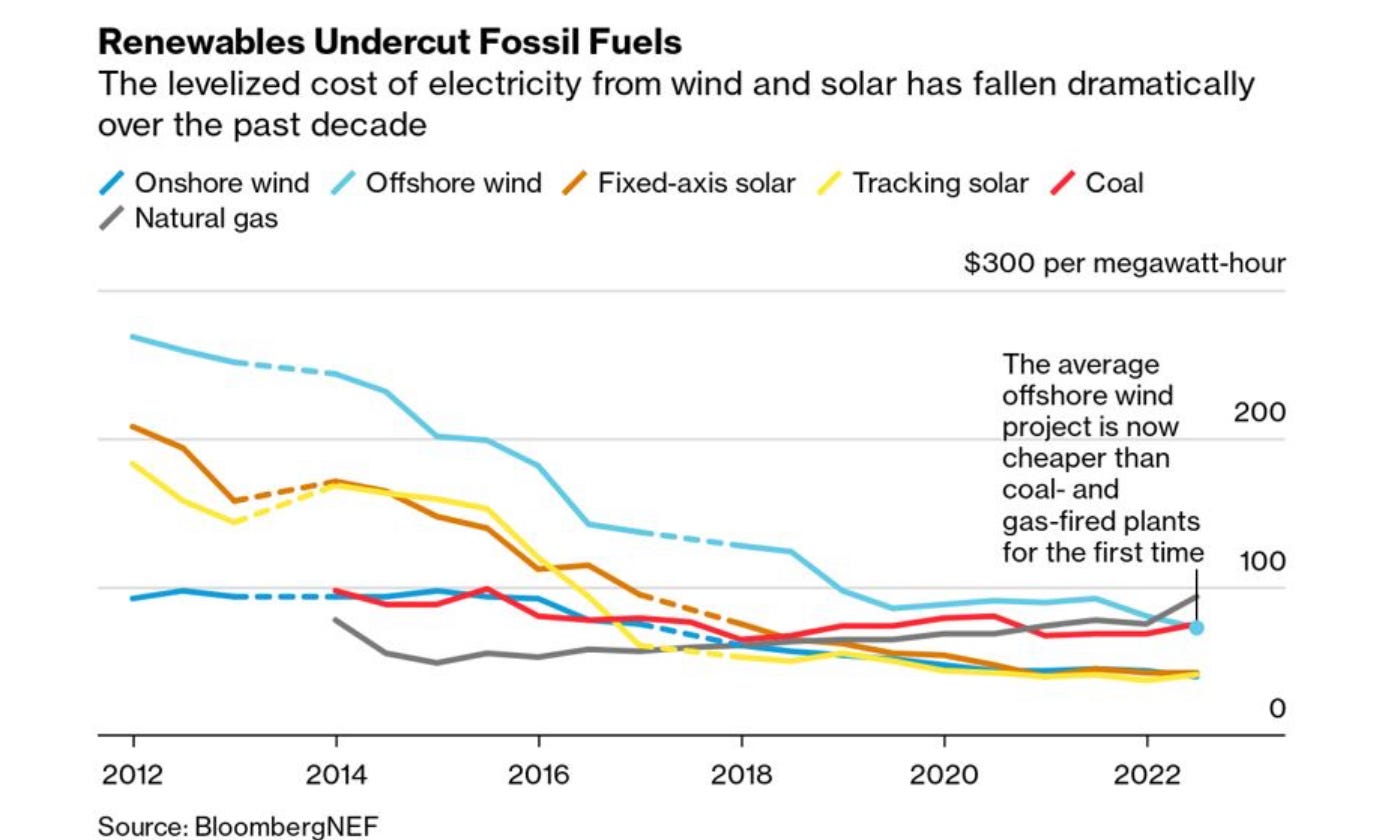

Chart of the week - Fossil fuels are the most expensive power generators!

After many years of free-falling costs for renewables, we can affirm that all traditional forms of renewable electricity generation are now cheaper than burning gas and coal. In fact, in the second half of 2022, even off-shore wind has finally undercut coal, thanks to cheaper wind turbines produced in China. Thinking about the long amount of time necessary to extract coal, as well as its elevated costs compared to wind, Germany’s decision to go ahead with a new coal mine seems even more absurd! 😳

Company of the week - Redwood Materials, recycling king 👑

In line with our innovation piece of the week, this week’s company is one involved in recycling batteries: Redwood Materials. The company, founded by Tesla’s former CTO JB Straubel, operates a battery recycling plant in Nevada, U.S. To put it simply, it receives all kind of consumer/manufacturing waste containing batteries, it separates materials using the hydrometallurgy process described above and eventually produces valuable re-usable materials. Its current plant is expected to produce material for 1 million lithium-ion EV batteries by 2025, ramping up to 5 million by 2030.🔋

Comment of the week - Energy Technology Perspectives Takeaways

Last week the International Energy Agency (IEA) published the “Energy Technology Perspectives 2023”, a report on the future of the energy transition with a focus on its technologies and their supply chains. It’s extremely insightful but ~450 pages long, hence we thought it would be a good idea to summarise the key takeaways (in our opinion)!

The clean energy transition offers huge employment growth opportunities 📈

If countries fully implement their announced pledges, clean energy technologies could be worth $650bn a year by 2030. Hence, clean energy manufacturing jobs would more than double from 6 million today to 14 million by 2030. Half of these jobs would be in the EV, solar PV, wind, and heat pumps segments.

There are serious risks posed by the concentration of clean technologies’ supply chains 😬

As we showed you in last week’s edition, the manufacturing processes of clean technologies are extremely concentrated. This poses high risks, as supply chains could be easily disrupted due to geo-political tension or natural disasters affecting one single country.

Governments are racing to win as much market share as possible on clean technologies manufacturing, but they should better think about the right segments to focus on 🧐

The US has the Inflation Reduction Act, Europe has the Fit for 55 package and REPowerEU, Japan has the Green Transformation program, India has the Production Linked Incentive scheme, and China has plenty of renewable goals in its Five-Year-Plan. However, not all of these plans will work appropriately: developers are still waiting and looking for the best place to invest. This is why, for example, only 25% of the announced manufacturing PV projects are under construction. ➡️ Countries should think in depth on where to allocate their resources, as it is not realistic for any of them to compete effectively on all parts of all the clean technologies value chains. They need to understand where their competitive advantage is.

Some sectors will see oversupply and some others will face shortages, according to announced plans 🙄

The current global pipeline of projects for Solar PV, Batteries, and Electrolysers is expected to exceed demand, while that for wind components, heat pumps, and fuel cells is expect to fall significantly short. This highlights the need for international cooperation and for clear and credible targets in order to better guide developers’ investment decisions.

Critical minerals sourcing and manufacturing is the segment that poses the most challenges 😰

Mineral sourcing and production is the most likely segment to cause a bottleneck to the energy transition. This is because new mines can take up to 10 years from discovery to production. Furthermore, the high geographical concentration of this sector increases the risk of being disrupted.

👋 See you next Friday, for the best sum up of this coming week!

If you enjoyed this edition, help us grow by liking this post, and share it with your network!